ĠEMMA and Malta Bankers’ Association launch 2nd project on digital financial literacy amongst pensioners

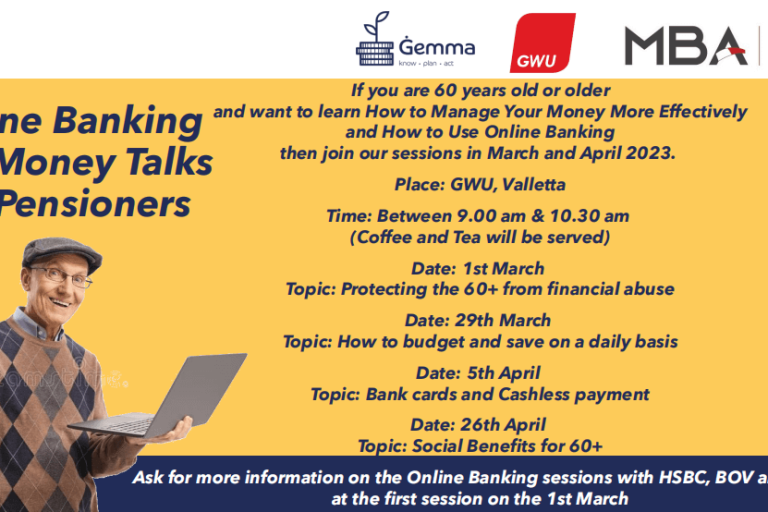

PRESS RELEASE February 2023 Following the successful collaboration between ĠEMMA and the Malta Bankers’ Association (MBA) in delivering a financial literacy pilot project for pensioners, that ran last October 2022…