When it comes to money – do you know what your personality is? Do you spend, and let tomorrow worry about itself? Do you worry so much that you save every cent you can so that you are prepared for any future eventuality – whilst losing out on today?

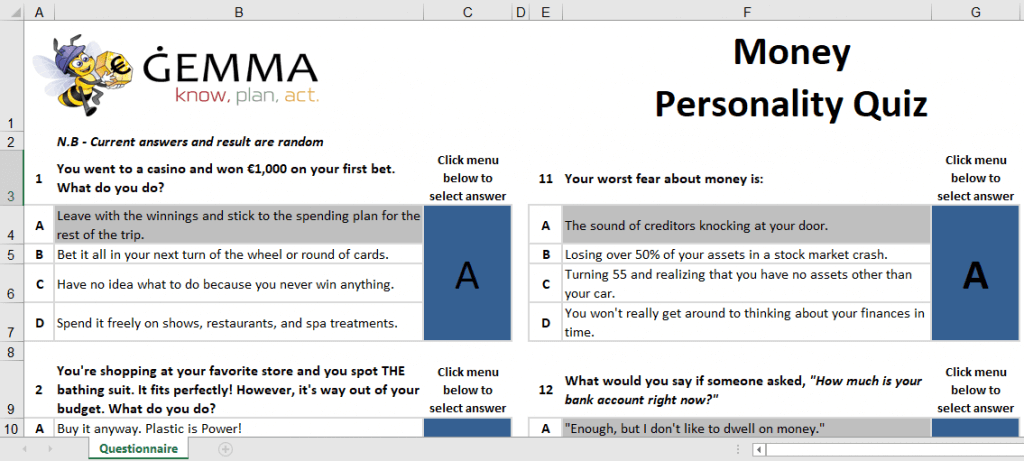

ĠEMMA is pleased to make available the My ĠEMMA Money Personality Quiz. You can download this by clicking here. Try out the Quiz and see what is your money personality: You can be one of the following four personalities – are you a:

If you are a saver you are deeply attached to your money. Your primary focus is that of saving money, and one of your highlights in your life is seeing you bank account grow. You will look out for saving opportunities – coupons, sales, competitions, loyalty cards, etc. – and you make good use of them. You understand the difference between wants and needs, are able to budgets, and prioritise your financial goals, You are however less like to take on much risk. Being a saver you are comfortable with the fact that keeping your money in the bank is your safest money management option. You often do worry what your retirement will be like, and whether you would have sufficient income to last you during your retirement. You are like to buy the occasional present for your loved ones – but you are likely to skimp when it comes to spending on yourself. As a saver your key priority is to be secure financially, and your ongoing concern is that you are not and that you will never have enough to be secure.

If you are a worrier you make careful decisions and, often, much fewer errors. Spending money is stressful to you because you are concerned with how much you money you have — and you are constantly concerned. These money worries often make you feel quite anxious and you can have impulsive reactions that can lead you to poor financial decisions. Your fear of financial stress often causes you to stress out more. Being a worrier is not necessarily always negative. You are in control of your cash flow – and if make sure that your finances are robust enough to face, at least in the short and medium term, a financial set back. At best, as a worried you help your family to maintain a solid financial footing. At worst, you may forgo opportunities for growth due to risk concerns, and fail to somewhat enjoy the ‘here and now’ as money worries dominate each financial decision you make.

If you are an avoider you rather do almost anything than to think about your money. An avoider typically handles financial matters at the very last minute, or even late–such as failing to pay bills on time and then having to pay additional interest and potential get clocked for a negative credit rating. You are less likely to keep financial records or a budget. You are likely rather quite fearful of making a mistake, so it is easier for you to do nothing. An avoider may feel some level of inadequacy when it comes to financial matters – wishing that someone else would just take care of their money matters. Money matters can be complex and confusing – with many details and decisions to make. At times it feels easier just to let the future to take care of itself. Too often, however, the future does not take of it self and you run the risk of not being prepared for some crisis that impacts your finances or for preparing for the future.

If you are a spender, you enjoy using your money to buy yourself goods and services for your immediate pleasure. You probably get satisfaction from spending money on gifts for others. You arer possibly also an impulsive buyer. The odds are that you have a hard time saving money and prioritising the things you’d like in your life. As a result, it may be difficult for you to put aside enough money for future-oriented purchases and long-term financial goals. You may spend most or all of the money you earn. You are likely to rack up credit card debt and that your expenditure patterns make it difficult for you to meet loan obligations on essential matters – such as paying off your mortgage. Working hard and partying hard may leave you in difficult straits in the event that event that you face a financial crisis – despite the income you may have earned you have nothing in reserve, and potential debts to pay off. Now, it is important to realise that some people who are in debt are not spenders; they may simply not make enough money to meet their basic needs. If your own income is insufficient to meet your expenses, you are facing a real money crisis. You will have to come up with strategies to generate more income.