With today’s ageing population and state pension income, saving for your retirement will prove to be very useful and is extremely important.

There are various investments in place, ranging from stocks, bonds and other financial instruments. However, investing your money in a private pension plan might be the best solution, even if you are familiar with the world of investments. These schemes will provide you with capital growth + the tax credit offered by the government.

Under current legislation, you may receive up to 25% of the amount you save each year, up to a maximum of €750 if you are at least 18 years old and are domiciled and/or tax resident in Malta. The credit would be set against any tax due. A “responsible spouse” may also receive tax credits for payments made into their spouse’s Personal Pension Plan.*

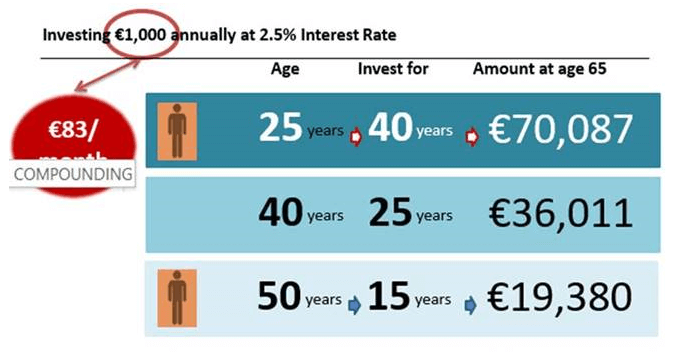

As mentioned, these plans will also provide you with an interest per year (in the form of compound interest) or capital growth depending on the fund chosen. If you want to build any kind of wealth, you will have to utilise the power of compound interest/capital growth. By putting a part of your monthly income into a current account, or into a jar at home, you will miss out on this valuable financial opportunity.

Compound interest is extremely powerful, but you need to give it enough time to see great results. So does capital appreciation. You won’t just invest one day and see amazing results after a couple of days. However, if you continue to delay to start saving money, you will end up seeing no results at all.