The first thing to tackle is… What is a budget? Why is it important?

It is a plan for managing your money and helps you plan for the future.

At the end of the week the user should think about whether:

At the end of the week the user should think about whether:

- Want to make the most of your money

- Don’t know where your money is going

- Don’t save money regularly

- Have problems paying your bills or debts

- Feel like you’re not in control of your finances

- Are planning for a major purchase like a car for example or a life event like a wedding

- Making a budget can help you feel better, less anxious and more in control of your money

- It can also help you to have more money for things that are important to you.

- plan on how you will pay for your bills and unexpected expenses

- saving for special events like a holiday

- help you control your spending, so you do not overspend

- understand how you are spending your money and evaluate where you can save

Before you Start Planning

The first step is to figure out what your GOAL is. It can be a short-term or a long-term goal. A financial goal is a milestone or objective you wish to achieve with your money. These can be paying off debt, saving money for emergencies or saving for a holiday. Although setting a financial goal state and makes clear what you’d like to achieve you still must take action to reach those goals. Remember that financial goals may change: When setting financial goals, remember to consider lifestyle and responsibility changes. If this year you had a baby your lifestyle and expenses may have changed drastically, and this should be reflected in your goals Revise your goals regularly to confirm if they still meet your needs.Why is setting goals important?

- Setting a goal helps us to visualise and create our future.

- It helps us assess our current situation -in this case our current financial situation- and decide where we want to be.

- Starting with what you want to realistically wish to achieve is a good way to understand which goals to set.

- Having goals also helps us be decisive. We get to decide what we want to focus our energy on, how we want to improve our lives and where we want to be in the future.

Different types of goals:

There are three types of financial goals, long-term, medium-term and short-term. In this case, we shall be learning about short-term financial goals and long-term financial goals. Examples of short-term goals:- Paying off your credit card

- Reducing your spending

- Starting to build an emergency fund

- Tackling all your debts

- Planning for the future

Know where your money is going

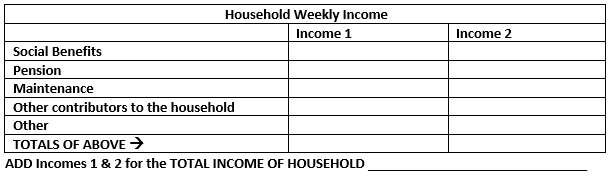

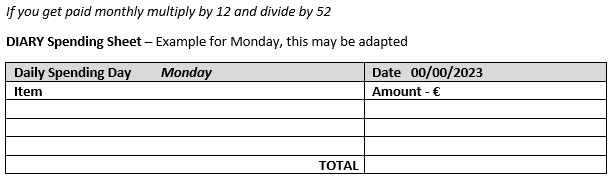

You must track keep of your money: you have to know what comes in and what goes out of your pocket every day. Every euro you spend affects your overall budget. With this knowledge, you can make decisions about future spending. Start by keeping track of your spending for a week and then extend it to a month to include your monthly expenses. You can use the Gemma Budget Planning app or a spending diary. Fill in your diary or input in the app every day listing where you spent money or gave money to the children etc. At the end of each day, you will know how much you spent. When you add this up, every week or over a number of weeks, you can begin to get a picture of where your money goes.Income

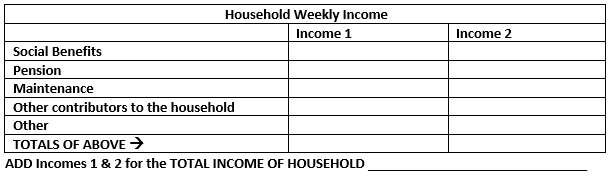

Fill in your expected income for the month. Things to include under Income are:- Wages and salary after deductions (Only include overtime if it is regular)

- All social benefits payments

- Contributions from all other people who live in the household who contribute to the household income such as grownup children (also known as non-dependants).

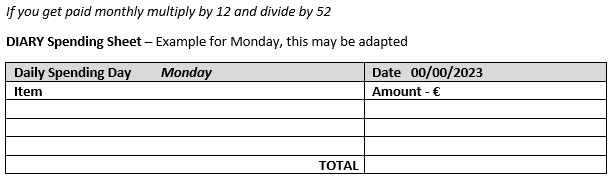

Spending

Start on any day you wish – just remember if you are using a diary and not an app, to start a new diary on the same day each week. Write down all amounts for all spending, no matter how small. Don’t forget that cola or coffee, your petrol or the bread, eggs and milk you bought from the corner shop. There will be lots of times when you spend money on items which are not regular, and this might not seem important, but they will give you a complete picture and you may be spending a lot more on these little things than you thought was possible.Bills

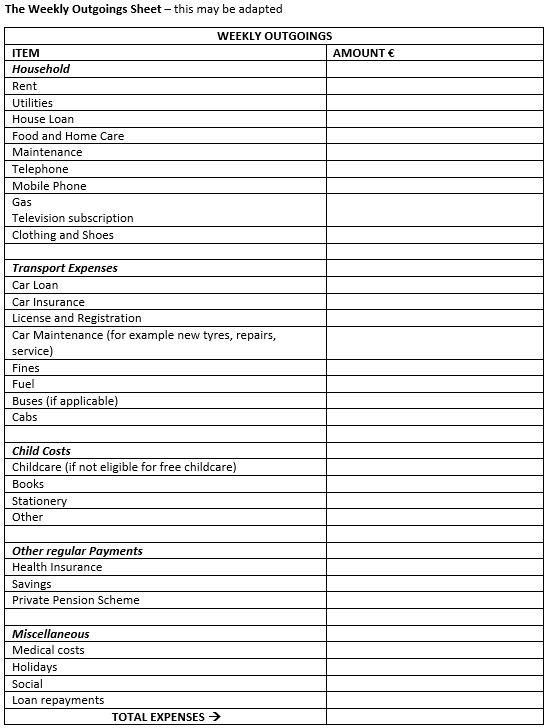

You can include them in the diary if you pay them on a particular day. If not, just make sure you list them in your monthly outgoings at the end of the diary. You can list them as recurring expenses in your budgeting app. These could be rent, Television/Netflix, your mobile phone bill, etcEnd of Week

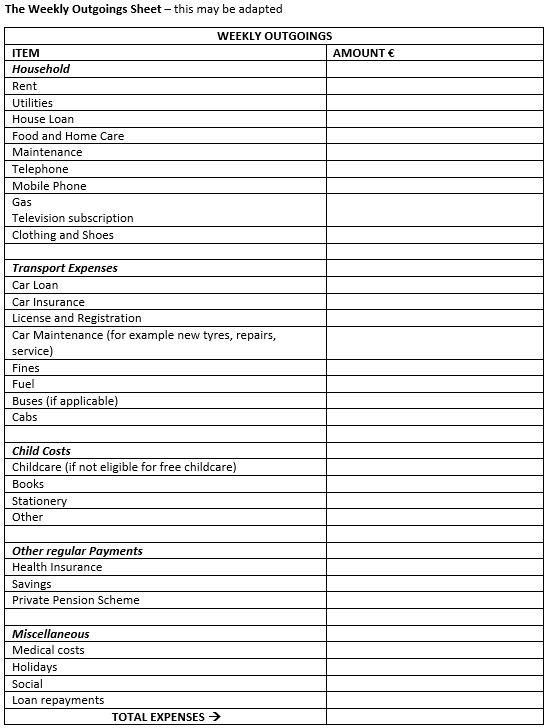

When you have completed the diary for the first week, transfer the figures for each day to ‘Weekly Outgoings’ at the end of the diary. There are a lot of categories here (food, pay-as-you-go mobile etc.) but many of the categories do not change from week to week. Some examples of categories are:- Rent

- Transport

- Fuel

- Food and home care

- Utilities

- Insurance

- Mobile bills

- Internet bills

- Saving, Investing, & Debt Payments

- Personal Spending

At the end of the week the user should think about whether:

At the end of the week the user should think about whether:

- they would have paid less if they bought in cash instead of card

- if they have shopped around to find the item cheaper

- if they have put aside any money for savings

- if they have tried checking for outings/ activities this weekend which are free

- if there were items they could have done without, if they could save more or cut back on certain expenses.

Think about Needs and Wants (see relevant article)

Once you have carried out the budgeting app / money diary exercise you will know where your money is going. Now is the best time to decide which things are your ‘needs’ and which are ‘wants’. Needs are the essential items you need to live, for example paying for the rent of the place where you live or electricity. Wants are everything else or the things you could live without. At this point you must rank your non-essential expenses. Have you’ve figured out your needs and wants? Perfect now you are ready to start working on your budget.Creating your Budgeting Plan

After carrying out the diary/ budget app exercise you should know how much monthly income you have and how much you spend. Ask yourself if you can reduce your expenditure by cutting down on unnecessary wants and if you can increase your savings amounts. Apply these changes realistically. After having done all the above you can pick a budgeting method and monitor your progress. ĠEMMA recommends that you try the 50/30/20 rule as a simple budgeting framework. This means you must allow up to 50% of your income for needs, this unavoidable expense would include the payments for all the necessities that would be difficult to survive without. Your most essential costs should be covered by 50% of your after-tax income. Leave 30% of your (after tax) income for wants, that is non-essential expenses, the things you choose to spend your money on even though you could live without them if you had to. Then commit 20% of your income to savings and debt repayment. This does not mean that you should stop keeping the diary or using the app as it is the best way to ensure you stay on track. REMEMBER if your income is not enough to cover your expenses, adjust your budget (and your spending!) by deciding which expenses can be reduced. Revisit your budget every quarterly. TIP: USE OUR EXCEL 50-30-20 EXCEL TOOL – Click here to download Envelope Budgeting System If you need to be more disciplined with your spending habits ĠEMMA recommends using the Envelope System.- Confirm your monthly income and expenditure.

- Set Budget Categories. The next step for the envelope budgeting is choosing which categories to put in your budget. Rent, utilities, phone bills, groceries etc

- Set Budget Amounts to Each Envelope

- Spend the Cash monthly in Each Envelope

- For this budgeting system to work you can only spend the money that you have on hand.

- Using the envelope budgeting system requires a certain amount of discipline to avoid overspending. You’ll also learn your priorities fast: food over entertainment, for example.