The difference between needs and wants may seem quite straightforward to adults but to the younger generations, the lines may be blurred.

Prioritise your budget and take charge of your money. How do you do that?

First things first. Identify where your money is going on a day-to-day basis. Once you start doing that, you can get a better overview of your monthly expenditures.

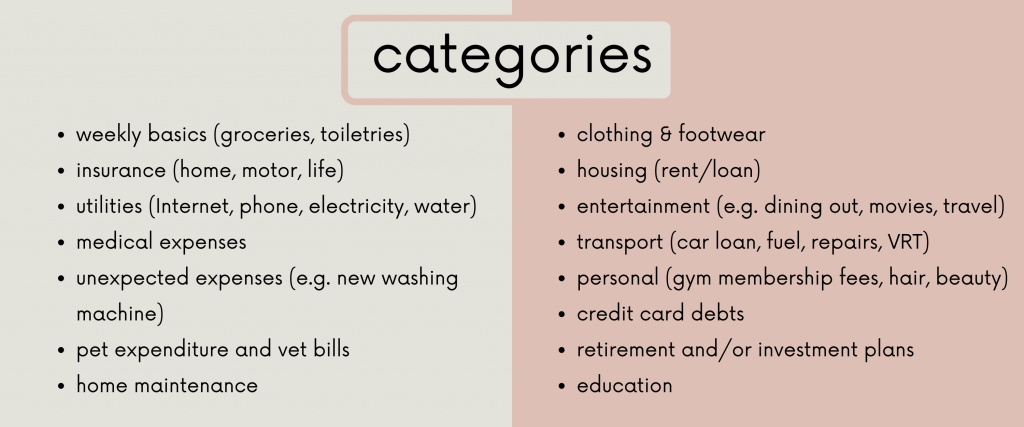

True, there are a lot of financial categories to consider. Prioritise and give each category a number. You would soon realise that those expenses with the highest priority ranking are the ones that are essential to you and your family. Namely, food, clothing, and housing. These are ’needs’. Whilst you can live without a mobile phone you cannot live without food or water.

Ranking might change, depending on the circumstances. For example, when a home or car insurance is due, it is imperative that this is paid without delay.

These are the things and services you desire to have to make your life more comfortable and pleasant such as the latest smartphone release, a smart watch, or a subscription streaming service. A want is something you would like to have, but not crucial.

Ask yourself:

1. Do I really need this?

2. Can I afford it?

3. Can I do without it?

4. Am I putting my basic needs first?

Find a balance between (a) your needs and wants in the short term with (b) the personal financial goals you want to attain in the future.

Instant gratification is the desire to experience pleasure or fulfillment NOW. Receiving a must-have item without the delay. This could be anything – from a fast-food drive through to downloading a video game release instantly.

It’s akin to temptation, and results in a tendency to forego a future benefit to obtain a less rewarding but more immediate benefit. These sudden impulses can cause us to forfeit our long-term in order satisfy our immediate desires which often, are less rewarding in the long run.

Why is it a problem?

Saying no to instant rewards to save for a future financial goal is uncomfortable and the waiting time is sometimes, painful. Yet, brief, instant pleasures result in more long-term pain because you’re missing out on what you could have achieved in the long term. The poorer financial decisions you take, the harder it will take you to reach your intended future goal.

Satisfying immediate rewards does not only hinder you from accomplishing and postponing long-term goals. Immediate rewards do not add any value to your life as their good-feel factor is only momentarily and short-lived.

Delayed gratification

This is when you resist the temptation of an immediate reward for a much better and longer future gain. Having a good well-thought budgetary plan together with a little sacrifice and patience, you will achieve your long-term financial goals, affordable by saving with underlying long-term benefits.

How to avoid Insant gratification

• Prioritise your needs & wants (refer to the above categories)

• Eliminate unnecessary expenditure

• Track down expenditure

• Establish worthwhile financial goals

• Think of how you can increase your disposable income and save for a future goal

Have you ever bought things on impulse and then felt guilt or regret for having done that purchase? Cosmetics which you do not need, new stationery items for every scholastic year, costly fashion jewellery, extra groceries that do not fall under the ‘need’ category.

Impulse buying is perhaps the most dangerous enemy of saving money. It is the unplanned decision to buy something – be it a product or a service. It can happen when you find something you may have long wished for or anything which is on sale and you buy the item there and then, fearing of missing out. At times you even manage to convince yourself that you need the item.

Impluse buying can become a problem if not controlled, especially if you end up spending more than you can afford.

Retailers want you to buy on impulse.

Remember those items placed at the end of each aisle or next to the till? They want to make it easy for you to grab the items as you go without giving it any thought/ Retailers may also ask for your details, allowing them to build a profile on you: what you buy, what you like, how much you spend and the likes. They can tag you online, text or email you advertised goods/services such as new stocks and sales.

How can you reduce your urge to impluse buy?

Quick questions to ask yourself in the moment:

- Do I need this right now?

- Would I buy this if it was not on sale?

- Will I get enough use out of this?

- Can I get this for less?

- Do I have the money for this?

source: https://www.bankrate.com/financing/saving-money/5-questions-to-ask-before-an-impulse-purchase/

Quick tips to avoid impulse buying:

- Acknowledge your weakness

- Sleep on your urge

- Refrain from using cards

- Avoid shopping centres

- Have a budget and abide by it

My ĠEMMA Budget Planner

Track your spending by making use of My ĠEMMA Budget Planner tool which is easily accessible. This tool enables you to list your expenses against your income to achieve your financial goals.

Hey, remember that your decision today instantly affects your tomorrow. Learning how to distinguish between needs and wants is key because you will be able to finance your present and future needs whilst saving for more rewarding wants!

Failure is part of the learning process. Making mistakes is a normal part of life and you should not let failure lessen your motivation. Learning takes place when you acknowledge mistakes, and you face up to them. The most important thing is to get back on track.