The term Self-Employed as referred to in the Social Security Act and its meaning differ to the way we use them in normal conversation.

Strictly speaking, the terms ‘self-employed person’ or a ‘self-occupied person’ both refer to a person who

- is not an employee working for an employer;

- derives income of more than €910 per annum from an activity;

- pays class (II) social security contributions.

Normally, the term self-employed is referred to anybody who works for himself/herself. It is the type of activity that differs.

Self Occupied Persons – persons who earn income from Trade, Business, Profession, Vocation or any other economic activity that exceeds €910 per annum.

Self Employed Persons – persons who receive income from rents, investments, capital gains or any other passive income (the person is not actively involved, yet there are incoming earnings)

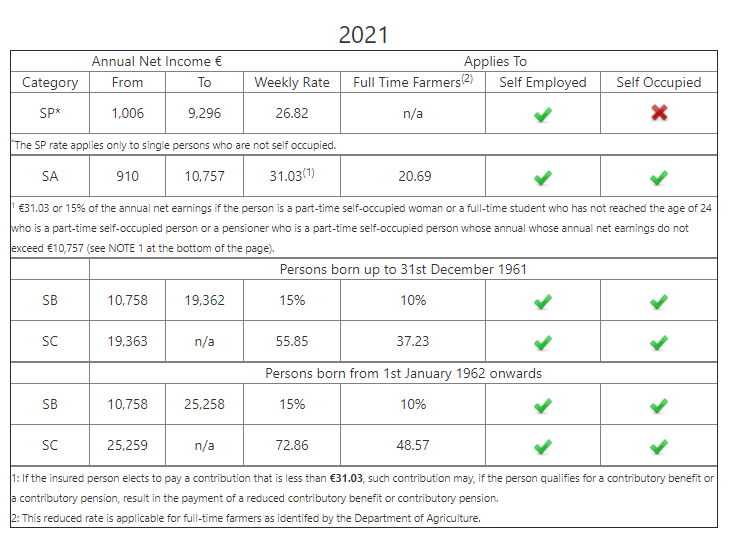

Both pay class II social security contributions as per below: