The social security contribution is also referred to as ‘bolla’ in Maltese. ‘Bolla’ refers to the ‘stamp’ that used to be manually affixed to a person’s notebook showing the number of contributions a person paid. A social security contribution is also referred to as SSC or NI, in abbreviated terms.

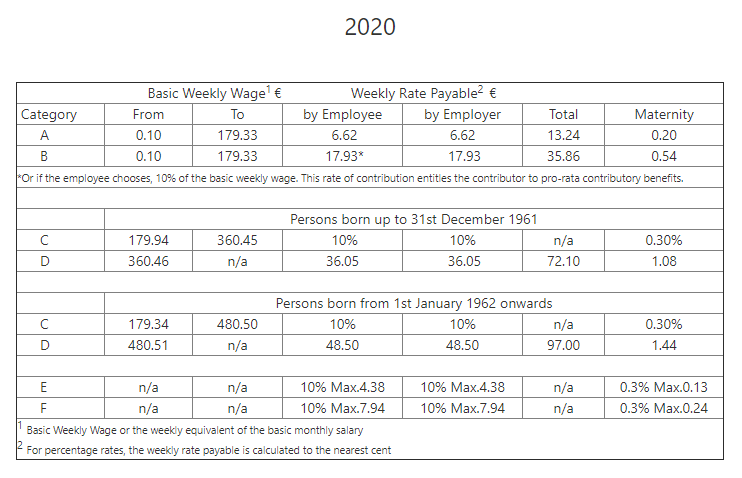

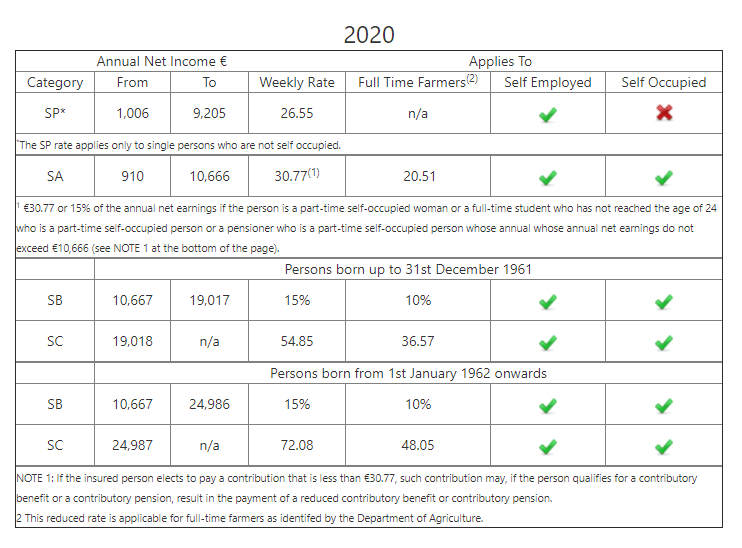

The amount of contribution that is paid depends on your gross wage or salary (in case you are an employee) or profits (in case of a self-employed), deducted as a pay-as-you-earn arrangement prior to you receiving your wage or salary in case of employees. For self-employed persons, contributions are paid at the Inland Revenue Department – Floriana – in April, August and December and contributions paid are based on the profits of the previous year.

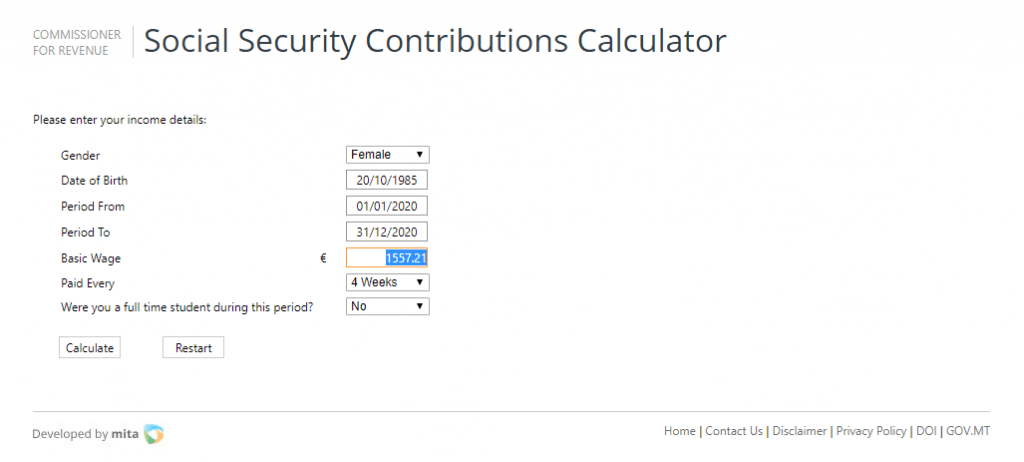

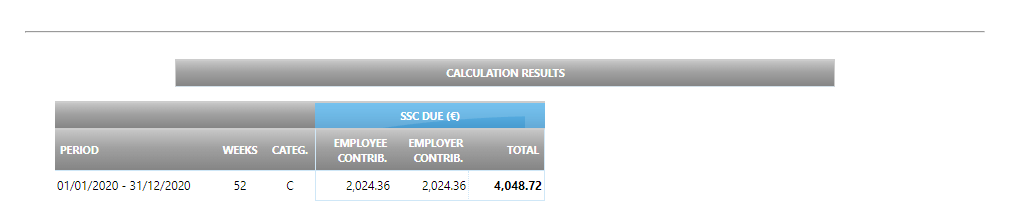

Example:

The payment made by the employee and employer in relation to example above:

- contribution average

based on the number of social security contributions that you have built up - pension entitlement

apart from the fact that pension rate is subject to the contribution average result, best years chosen have to have a full year of social security contributions paid (52) - other contributory benefits

such as invalidity pension - possibility to retire at 61 if desired

to retire at 61, certain conditions apply (for example: persons born during 1959 & 1961, need to accumulate 35 years of social security contributions, meaning 1820 contributions to apply at 61) - opportunity to benefit from the full percentage increase measure

this measure is a top-up pegged to the postponement of pension beyond the age of 61 and is linked to having had enough contributions to claim a pension at 61 but refused option, delayed pension and chose to work past age 61 for another year, two, three, four years.

For employees having reached the age of 59 but not yet the age of 65 , are still in employment and have missing contributions that affect pension may pay up to five years of arrears of social security contributions at the SA rate applicable in the year the claim is made. Weekly SA rate stands at €30.77 (year 2020).

An application is filled in at the nearest District Office, a bill is sent to fill earlier gaps and all payments must be settled at the Inland Revenue Department whilst in employment and before applying for your pension.

If social security contributions are paid after start date of pension, same conditions apply and revision of pension rate is carried out with effect from payment of these missing contributions.

Missing contributions, in the last five years prior to retirement year definitely affect pension. The five-year rule applies to self/employed persons and missing social security contributions for the past 5 years and respective dues can be settled with IRD. During year 2020, self/employed persons can settle social security contribution dues from 2015 to 2019.

Self/employed persons can also benefit from a correction of income declared if income declared with IRD was relatively less.

Furthermore, in case of other missing contributions, they can be bought by the week at the age of 59 up to a maximum of five years of arrears of social security contributions at the SA rate applicable in the year the claim is made. In year 2020, each missing contribution will cost you €30.77.

All payments must be settled whilst in employment and before applying for your pension. It’s best to approach District Offices if you want to fill earlier gaps. If paid after start date of pension, revision of pension rate is carried out when payment of these missing contributions is made.

– Never hesitate to ask for a tentative assessment which gives you a state pension forecast making it possible for you to reflect and sort things out. A pension prediction entitlement is always based on your current contribution history and for those in employment, assumes that contributions are made up to retirement date. In case of missing contributions, you may query your difference in pension rate if unpaid past contributions are settled.

– Furthermore, you may request a social security contribution record sheet at any time, which illustrates each year of your working life and tells you how many national insurance contributions were paid. Deficient years can be turned into complete years at the age of 59, as explained here.

– If missing contributions are noted whilst in employment, it does not necessarily imply that the employer has failed to pay them on your behalf. The Department of Social Security can help by sending a letter, which you would need to present at IRD, requesting FS3s as guided by the Department.