Early on in your mid-20s you took the decision to start planning for your retirement – by saving in a retirement plan and later after you paid the mortgage and the kids left the nest by saving in a bank account.

My decision to plan for retirement was influenced by various campaigns carried out ĠEMMA Know, Plan, Act which underlined that for my wife and I to enjoy a quality of life that is similar to that we enjoyed whilst I was employed I had to complement my social security contributory pension by additional savings.

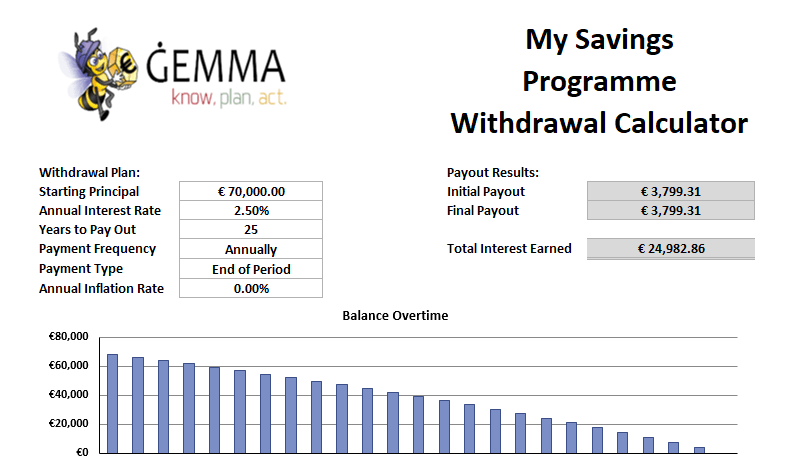

On the day I retired at 65 years of age I had put together a retirement nest egg of €70,000. The following are planning considerations that I discussed with my wife on how we are going to use these savings:

| Will draw down up to nearly 90 years of age | Annual draw down of €3,800 |

| Will drawn down up to my life expectancy – 79 years of age | Annual draw down of €5,987 |

| Will drawn down up to my healthy life expectancy – 74 years of age | Annual draw down of €8,792 |

As you can see from the above Table, depending on the decision you take you can increase your pension income as a result of your savings by €3,800 to €8,792; depending on the decision you take.

You are able to draw this amount as over time your retirement post is being annually topped up by a compounded interest. The ammount of top, however, decreases from year to years as your savings decreased as a result of the programmed withdrawal.