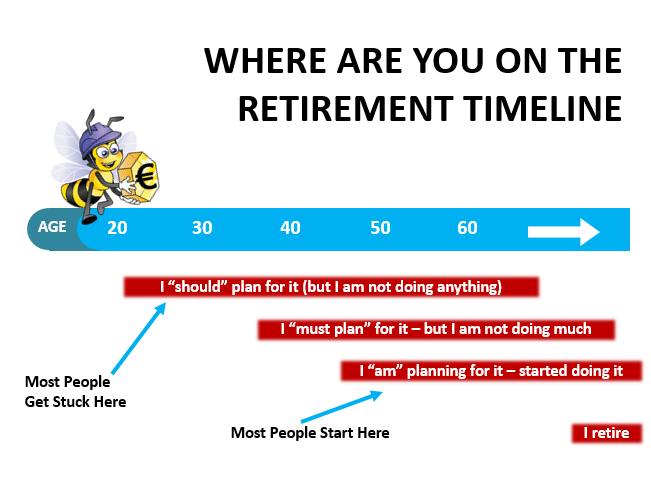

Most people do not start planning for their retirement until they are in their late 40s. There is a reason for that. At the start of your first job or on completion of tertiary studies, between the age of 18 and 23 , the last thing on your mind is retirement. Most people want to indulge in travelling or buy their first car, among other priorities. At a point in time in their later 20s / early 30s they decide to enter into a relationship or get married and raise a family which brings with it long term structured costs – a mortgage if one opts to buy a house and investment in education if one has children. This is at least a 20 year cycle where your ability to put money aside for retirement is challenging whereby the imminent priorities supersede your long term planning for retirement.– even if during this period one’s compensation package increases considerably.

So here we are: in the late 40s / early 50s. In this phase of a person’s life retirement starts to loom on the horizon. Retirement is around 15 years away – at 65 years. Suddenly one finds that they have a 15 year period to build a retirement nest egg. It is important to note that building a strong retirement nest egg is dependent on two principles: compound interest and time. The earlier you start saving the more powerful is the impact of compound interest. So if you invest €1,000 annually for your retirement from the age of 40 years, at a 2.5% interest rate, your retirement nest egg will be €70,087. On the other hand, if you start planning for your retirement at 50 years of age, under the same conditions, your retirement nest egg will be €19,380.

It is pertinent to note that if you are born on and after 1962, the maximum pensionable income is €24,986. The maximum social security contributory pension that you may be entitled to is 2/3 of that – €16,657. Thus, if your compensation package is say €40,000 – the maximum pension income, if you are entitled to it, is 42% of the income you earned whilst in employment. Research shows that for you to have to a moderate quality of life during retirement, your pension retirement income should be at least 60% of the income you enjoyed in employment.

How do you bridge this gap between retirement income and the income earned during employment? One important way is in investing in a personal private pension scheme. In 2015, the Government launched a framework that is designed to ‘incentivise’ you to invest in a personal private pension scheme. The scheme is designed in a manner that up to an annual contribution investment of a maximum of €2,000 in your personal private pension you will receive a tax credit of 25%. Thus for a maximum annual investment of €2,000 the tax credit you are entitled to is €500.

ĠEMMA suggests that you look strongly at the personal private pension scheme. There are today a number of products on the market. 25% return (through the tax credit) on a maximum contribution investment of €2,000 is extremely attractive considering the interest misely rates for current, savings, and fixed term deposits provided by banks today.

The scheme allows you to withdraw your investment and accumulated profits between 61 years and 70 years of age. You can withdraw 30% as a tax free lump sum, and the remaining 70% as annual programmed withdrawals, which are subject to taxation.

ĠEMMA advises you to talk to a financial consultants and discuss with them whether this is an appropriate retirement planning investment for you given your financial circumstances.