It is essential to understand your and your spouse’s “money personality,” as we all have a unique way how we think about money — often shaped by how we were raised as a child. And our life experiences can cause us to feel specific patterns when it comes to spending or falls into certain habits. It can be hard to understand your relationship with money. You may be aware that you have certain tendencies regarding bills, buying gifts, and saving, but not entirely sure why.

And your money personality may impact your happiness in a relationship. Previous blogs on Money Problems and Divorce showed that money is a significant stressor on marriage or a relationship and a leading cause of divorce. So money management complicates itself when you enter into a relationship: your partner or spouse may have a completely different outlook to managing money from the one you hold: your spouse may be very frugal whilst you tend to be more relaxed in managing your money.

Your primary focus is saving money, and one of your highlights in your life is seeing your bank account grow. You will look out for saving opportunities – coupons, sales, competitions, loyalty cards, etc. – and you make good use of them. You understand the difference between wants and needs, can budget and prioritise your financial goals. You are, however, less likely to take on much risk. You are likely to buy the occasional present for your loved ones – but you are likely to skimp when it comes to spending on yourself.

If you are a worrier, you make careful decisions and, often, much fewer errors. Spending money is stressful because you are concerned with how much you have — and you are constantly concerned. At best, as a worried, you help your family to maintain a solid financial footing. At worst, you may forgo opportunities for growth due to risk concerns and fail to enjoy the ‘here and now ‘ occasion as spending worries dominate each financial decision you make.

If you are an avoider, you instead do almost anything other than to think about your money. An avoider typically handles financial matters at the very last minute, or even late–such as failing to pay bills on time and then having to pay additional interest and potential get clocked for a negative credit rating. You are less likely to keep financial records or a budget. Money matters can be complex and confusing – with many details and decisions to make. At times it feels easier just to let the future take care of itself.

If you are a spender, you enjoy using your money to buy yourself goods and services for your immediate pleasure. You probably get satisfaction from spending money on gifts for others, and you are possibly also an impulsive buyer. The odds are that you have hard time saving money and prioritising the things you’d like in your life. As a result, it may be difficult for you to put aside enough money for future-oriented purchases and long-term financial goals. If your income is insufficient to meet your expenses, you are facing a real money crisis. You will have to come up with strategies to generate more income.

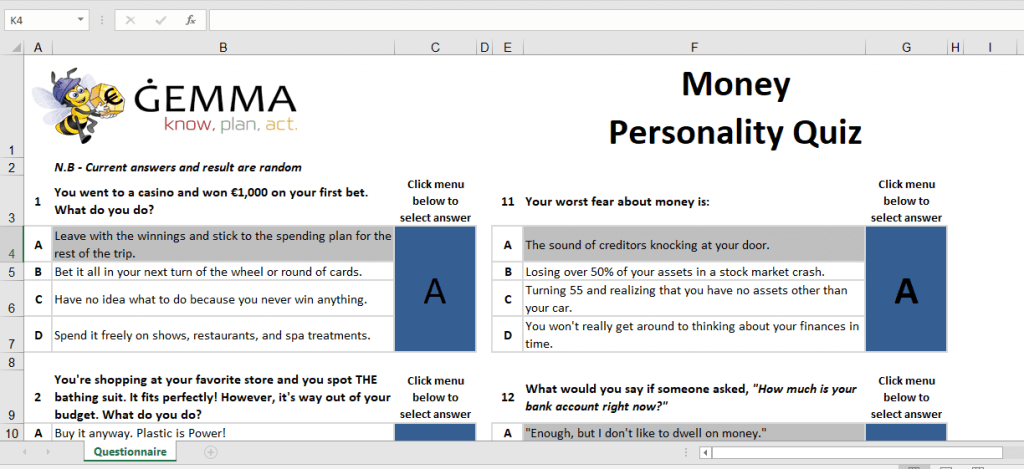

Download our ĠEMMA Money Personality Quiz, where we walk you through a few scenarios and ask you questions that may help you understand how you relate to money – and whether this may affect your life and your relationships.