Retirement – you must have thought about it!

To be free to do what you have long dreamt about; No more demanding working schedules; No more being caught up in bumper to bumper traffic to get to work; No more constant stress;

On retirement, finally, you are your own master.

To enjoy your retirement, you need a well-thought-out plan. The big question : Where do you start from? For many, retirement is a long way ahead, for others their main concern is how to manage till the end of the month, stretching out their pay, with retirement being the least of their concerns.

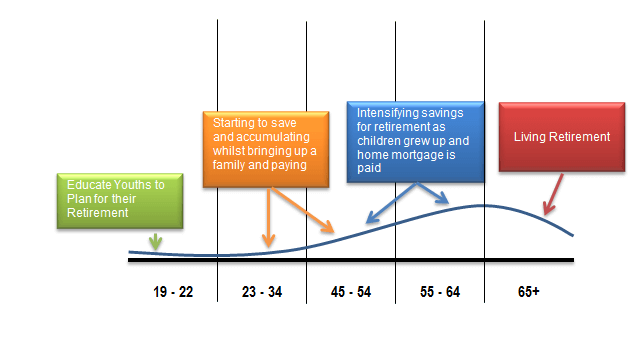

No two people have the same saving habits or goals or generate the same income; yet, some phases of the life cycle remain identical for most people. The chart below shows the life cycle of the average family.

A glance at the chart shows that the average family is likely to save for retirement in their late 40s or early 50s when they would have settled their mortgage (in case of a home loan) and when their children are old enough carrying out further post-secondary studies or are actually working.

In these scenarios, the average family has between 10 to 15 years to prepare for their ideal retirement – if they plan to retire between 61 and 65 years of age. The time period where money is added to the annuity will decrease and thus, the family will need to figure out how much more money they need to save for a decreased time frame to accumulate savings.

The question that arises is: “Does this provide you, (providing that you have the same profile as the average Maltese family), with enough time to boost your retirement nest egg to allow you to enjoy the quality of life you desired for your retirement?”

Do not forget, that it is never too early nor too late to become Gemma and start saving for your retirement egg nest. The amount of money to be invested– the intial capital and / or monthly / yearly savings — is also determined by the following factors :

– The quality of life that you envisage for your retirement and whether the social security pension and other assets you may hold will provide you with enough income to be able to meet your desired quality of life

– The amount of money that you can actually manage to put aside each month or year for your retirement nest egg.

– Decisions regarding when, where and how you will invest such savings to accumulate interests and financial returns on your savings.