Seems complex , yet so simple.

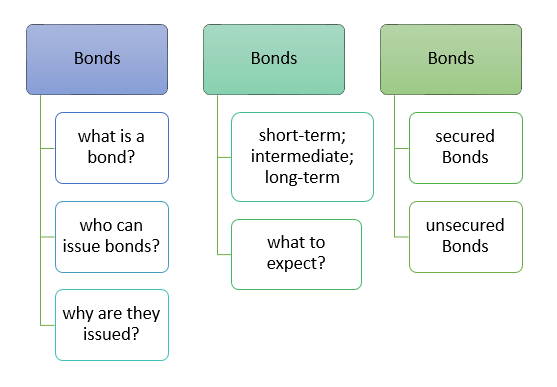

A bond can be thought of as basically a loan agreement. There are different classes of bonds, with differing bond characteristics.

Businesses and governments issue certificates of debt, called bonds. It is a certificate showing that the bondholder has lent a specific amount of money to a corporation or to a government agency.

The bond market is for participants that are involved in the issuance and trading of debt securities. It primarily includes government-issued and corporate debt securities, and can essentially be broken down into three main groups: issuers, underwriters and purchasers.

Governments, government agencies, and businesses engage in long-term borrowing for many reasons. Firms or governments may issue bonds for special projects, or through special purpose vehicles. The income derived from bonds is allocated to a specific project, such as an infrastructural project. The bond proceeds are then utilised to finance that project, and the coupon payments and principal repaid through the project’s revenue.

People or institutions who buy bonds (buyers or purchasers) expect, over a specific period of time, to recover the principal, meaning the amount of the loan.

Moreover, these bonds, that represent debts, will be repaid with interest (for the use of the money) periodically (at some specified date).

In fact, bonds are redeemable on maturity. Short-term bonds mature in from one to five years, intermediate bonds mature in from five to ten years, and most long-term bonds mature in from fifteen to twenty years.

Most bonds pay a fixed rate of interest.

Secured bond: In the event of a default or a bankruptcy, a secured bondholder has preference over other bondholders and shareholders.

Unsecured bond: Are bonds that are not backed by some type of collateral. In other words, the bond is only secured by the bond issuer’s good credit standing. There are no building, equipment, vehicles, or other assets backing up the bond.

Bonds confer no rights of ownership, but they do carry a legally enforceable promise to repay. Most bonds now are fully registered: the owner’s name is on the certificate, and when it is sold it must be sent to the issuer (the one who would have issued the bond) for a transfer of title.

Many people do not differ between stocks and bonds. While stocks are certificates of ownership, bonds are loan certificates representing money loaned to a corporation or government.