Losing your job is stressful and places a strain on your personal finances. Even if you have received compensation from a redundancy payment, losing your job can impact your ability to keep up with your financial obligations.

Keep your family in the loop

Keeping your family up to date with what is happening is an important part of the process.

When your partner, children and other family members understand the situation, they can be a valuable source of support as you make the adjustments to your situation until you find a new job.

Draw up a budget to cut spending

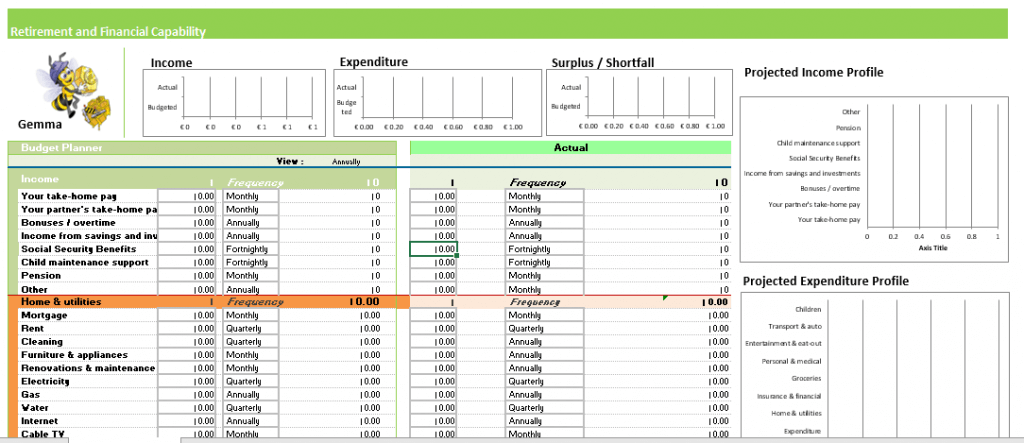

A good first step is to develop a budget so you and your family can manage. Reduce your spending until you find another source of steady income. Things will be a bit easier if you have savings or if your partner is working, but it usually makes sense to cut or reduce unnecessary spending.

- Make a list of essential and non-essential items, then prioritise your needs and wants and look for any unnecessary expenses you can cut to save money. Be prepared to make changes to your lifestyle.

- You can use Gemma’s budget planner to get started. Rent, mortgage, utilities, insurance and food are typical essential items.

- If possible, repay your credit card bills and other loans promptly to avoid additional fees and other consequences of falling behind on your payments.

Try to avoid the temptation to tap into credit. Make sure you avoid borrowing to:

o  Pay for everyday expenses. If you have trouble paying for daily necessities, borrowing money can put you into more debt.

Pay for everyday expenses. If you have trouble paying for daily necessities, borrowing money can put you into more debt.

o Cover optional spending. If you can put off an optional purchase until you are back in a job and saved up the money for it, you will avoid interest charges altogether.

o Borrow to settle other debts. – such as paying of credit cards by borrowing from other cards.

If you must borrow, before you borrow, make sure you can afford new debt payments on top of your current expenses or commitments, and avoid unnecessary multiple sources of credit to keep an easy track of repayments.

Consider taking the following actions:

- Do you have a serious budget shortfall? If so, talk to your bank and any other organisation you owe money to and contact them as soon as you can, especially if the lender has security over your home, car or other assets. Let them know that you are experiencing financial difficulty. In many cases, bankers may be willing to examine your situation and work with you to help resolve the problem. For example, you may be able to extend the term of a loan or arrange to postpone repayments for a temporary period.

- Pay off your debt as much as you can each month, at least pay the minimum you owe on each loan. If you can afford to pay more, pay the loan with the highest interest rate first.

- Prioritise secured debts like your mortgage over on-going payments on unsecured debts like credit cards, so you do not risk your home being repossessed.

- Review your budget as stated earlier. Are there any non-essential expenditures you can cut or delay to help pay off your debts?

- Consider consolidating your loans, lines of credit and credit card balances into a single loan with a set repayment schedule. By consolidating or refinancing loans, you may be able to save on interest charges and manage your debts with one single payment.

Check Your benefits

You may be eligible for severance compensation from your employer. Check your employment contract, or check with your former employer’s human resources department to see if compensation is due.

In some cases, you may wish to contact the Department of Industrial and Employment Relations, which may be useful in ensuring you get what you are owed.

If your former employer had a health or other type of benefits plan, your coverage may continue even after your employment ended. If you are unsure of the details, ask your former employer. Some companies provide outplacement services to employees made redundant.

You should also contact the Department for Social Security to discuss the benefits available to you and how you access such entitlement.

Review your investments

Take a look at your investments and see what can be easily liquidated without penalty or too much cost in case you need access to funds.

Consider education and retraining

You may consider using the time you are redundant as an opportunity to retrain and develop new skills that will enhance your employment prospects.

You may wish to contact Jobsplus. Look at training opportunities being delivered by Jobsplus by clicking here.

You may also wish to contact the Malta College for Science, Arts and Technology to check what courses are available. You can find a list of short or part-time courses by clicking here.