Perhaps the most dangerous enemy of saving money is impulse buying. Have you ever bought things on the impulse of a moment and then feel guilt or regret for having done that purchase?

A sudden desire for new dress for an occasion, cosmetics which you do not need, new stationery items for every scholastic year; costly fashion jewellery; many groceries not on the needy list.

What is impulse buying?

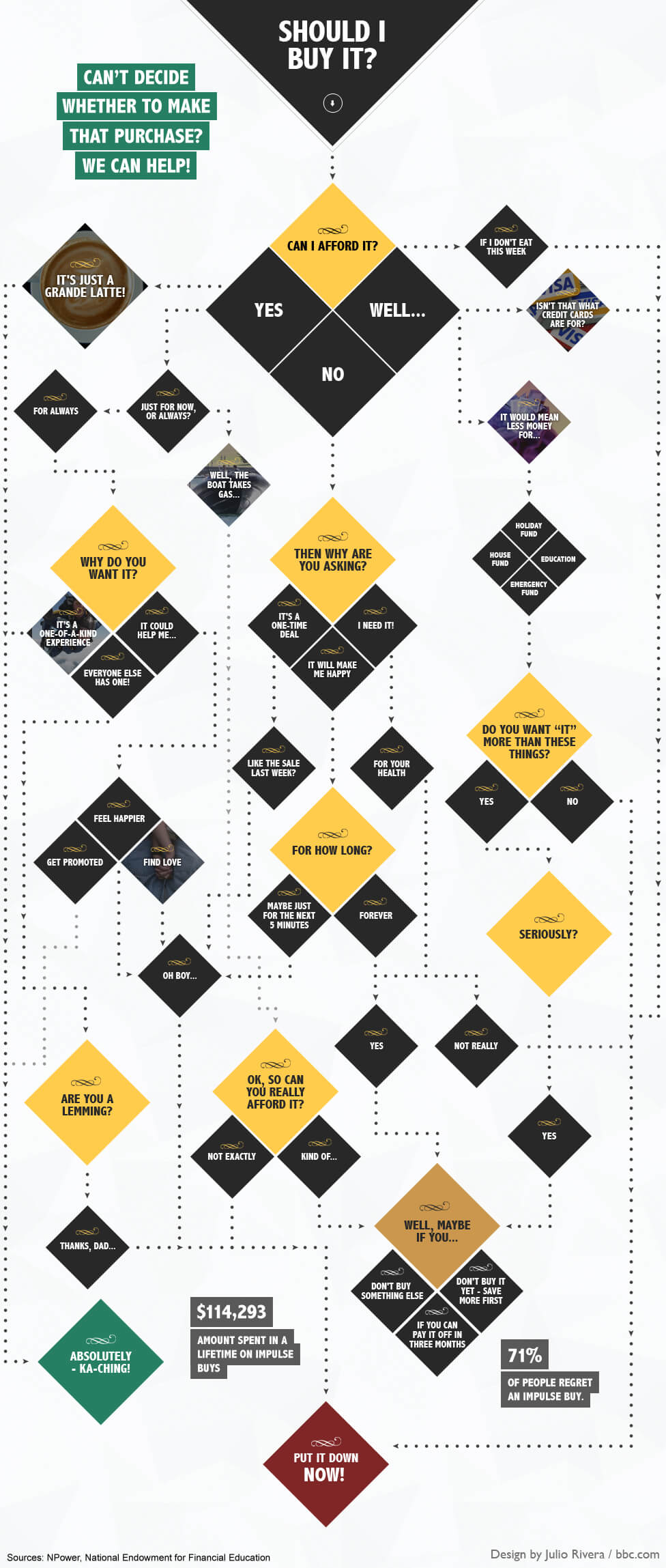

Impulse buying is the unplanned decision to buy something – be it a product or a service. Impulse buying occurs when you find something you may have long wished for or anything which is on sale and you buy the item there and then fearing of missing out . At times you even manage to convince yourself that you needed that item bought.

Whatever the reason, impulse buying, if not taken care of and controlled, is likely to become a problem particularly if this results spending more than you can afford.

Do retailers nudge us to impulse buy?

Yes. Retailers use many ways of getting you to buy something which you had not planned for. ‘Tricks’ used by retailers include placing items at the ends of aisles to be grabbed on your way out without much thought.

Nowadays, many retailers ask for your details, allowing them to build a profile on you: what you buy, what you like, how much you spend and more. Retailers would then tag you online by texting you a message on your mobile phone or emailing you to ‘advertise’ goods or services, especially new stock and sales.

Can I reduce my urge to impulse buy?

Yes. There are number of behavioural techniques that you can apply to combat your urge to impulse shopping.

Ask:

- Do I need this right now?

- Would I buy this if it was not on sale?

- Will I get enough use out of this?

- Can I get this for less?

- Where will I get the money for this?

source: https://www.bankrate.com/financing/saving-money/5-questions-to-ask-before-an-impulse-purchase/

If you know that you are likely to impulse buy when you receive your pay cheque then make it a point to avoid shopping on such days.

How many times did you impulse buy and then regretted your purchase? What may have seemed just the right thing to buy might look like clutter or not necessarily that desirable the day after. Sleep on your urge: you are likely to find that the desire has lessen the next day.

Use cash and leave your cards at home. When you go shopping do not take your credit card with you. Withdraw cash – on the basis of the budget you set for yourself – and leave your card at home. In this way, it is easier for you to keep track of what you are spending. Also if you have a number of cards – reduce the number.

If you are tempted to browse stores avoid shopping centres. There will be less items to tempt you. Go to the gym or take a walk other than window shopping.

Prioritise your needs and set out what available money you have for spending. Then, stick to that budget. Do not exceed it – you will soon find yourself not making use of your cards and with your savings on the increase.