Saving Money

You save money because you:

- Want to buy something in the future.

- You want a safety net in the event that something goes wrong.

- You want a quality of life when you retire that is nearer to that you enjoy now that you are working.

In planning to save you should ask yourself the following questions:

- What do I want to save for?

- How much money do I need to save?

- How much can I save each time I get paid?

- How long will it take me to reach my goal?

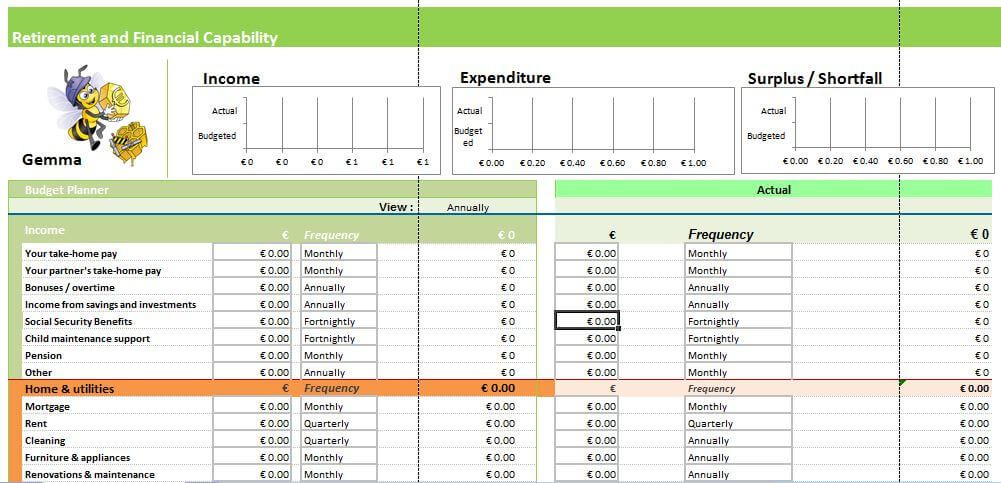

To save you need to track your spending. A valuable device for encouraging reflection and review is our downloadable calculator, accessed here, made for you to make use of other than to remain online. It can serve a variety of purposes, to:

- record incoming money and outgoing money

- compare expenses with cash inflows.

- improve saving

- lessen expenditure

- remind you of your fixed costs

- strengthen reflection skills

- monitor progress

Our calculator encourages you to Use Think Reflect regularly to successfully work toward your financial goals.

Reducing Your Expenses

An important aspect of managing your money is that of reducing your expenses. You can achieve this in various ways as is shown below.

- Resist impulse buying. Ask yourself these questions: Do I really need it? Do I need it today? What if I do not buy it now, can I do this at a lower cost?

- Limit the cash you carry.

- Shop with your spending plan in mind.

- Avoid ATM fees by using your bank’s ATMs.

- Watch out for sales.

- Wait for the right price.

- Look for coupons and rebates.

- Subscribe to membership cards to benefit from discounts.

- Shop for value!

- Save money by eating at home.

- Make a shopping list for the grocery store.

- Watch for sales and coupons.

- Shop for value.

- Subscribe to membership cards to benefit from discounts.

- Buy products you use frequently in large sizes or bulk quantities.

- With perishables buy in small quantities to meet your needs.

- Shop for a package deal.

- Watch out for high text messaging and web access charges.

- Purchase a package deal that gives you unlimited calls and texts when communicating with persons on the same mobile operator that you are with.

- Read the contract before you sign.

- Ask questions; make sure you understand all features and fees.

- Keep track of your usage.

- Pay your bill on time and in full.

- Use your credit card to purchase larger, lasting items – otherwise shop with cash as with a credit card you are more likely to spend than you can afford.

- Limit the number of credit cards you have.

- Do not use a credit card if you cannot afford the price.

- Avoid having a monthly credit card balance greater than 10% of your net income.