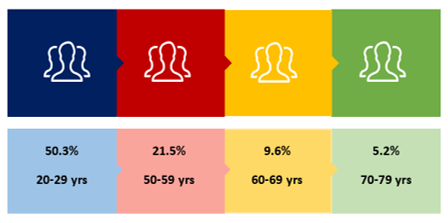

We are living in an increasingly mobile world, with Wi-Fi available almost anywhere, anytime, and more recently always on Internet. It is no surprise that just every bank in Malta now offers mobile banking capabilities. In 2018, ĠEMMA carried out the OECD / INFE national survey on financial literacy in Malta. The Table below shows the usage of a banking App by different age cohorts:

Recent mobile technology makes m- banking accessible to almost all card and account holders. Have you downloaded your bank’s App yet? If not, check it out. It will improve convenience and make it easier for you to manage your money. Here are some frequently asked questions about mobile banking:

It may be new technology, but it enables you to complete almost all traditional banking actions and provides some new capabilities. With mobile banking, you are able to check your balance, track your spending, review your account history, locate ATMs, deposit cheques, transfer funds, pay bills and receive text message notifications or alerts about your account.

m-banking serves a variety of financial purposes, but its best feature is the 24/7 access it gives you to your money. Whether you are making purchases or depositing cheques, you can do it from wherever and whenever you want. All banks provide their own m-banking Apps, tailored to their individual features and services.

There is a common misconception that banking through a smartphone puts your financial security at risk. These assumptions are understandable given how recent an advance m-banking is, but they are often unfounded. m-banking is becoming one of the most secure and convenient ways to pay and transfer money, especially with features like fingerprint technology and near-field communication (NFC) chips.

It is pertinent to point out that the ĠEMMA research shown above shows that m-banking Apps To the question of what banking apps are used, only 9.6% and 5.2% from the 60-69 and 70-79 age cohorts answered positively. These findings give rise to policy questions – whether the aggressive digitalisation of banking services that banks in Malta are undertaking will result in a digital divide that excludes elderly people from the use of banking services.