The ĠEMMA team has uploaded a new calculator –

Net worth is a relatively quick and easy calculation to make, and it’s a valuable way to track your financial progress and see if you’re really getting ahead. So what is net worth and how do you work out your net worth? Net worth is an indicator of your financial health.

This calculator will help you determine your net worth. What is net worth you may ask?

Net worth is the combined value of your assets, or the things you own that have a monetary value, from which you subtract the value of your liabilities, that is what you owe and are paying off.

Assets include such as in your current, savings and retirement accounts — and items such as cars, property and investments that you could sell for cash. These are known as Liquid Assets. Then there are other assets which known as Fixed Assets – such as your residential home and other property. Then there is what is known as Intangible Assets – for example the goodwill of your business.

Liabilities include money you owe to other persons or entities. These include credit card debt, personal loans, say, for your car, and the mortgage on your residential home or commercial business.

Use the ĠEMMA My Net Worth Calculator to find your net worth. If that number is greater than zero your net worth is ‘positive’ and it means you own more than you owe. If it’s less than zero your net worth is ‘negative’ and means your debts outweigh your assets

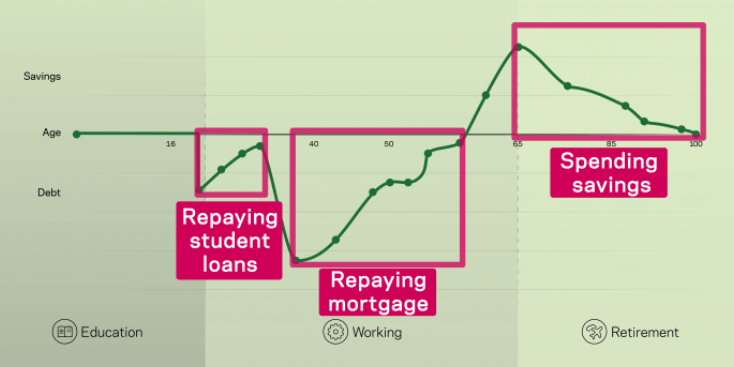

Net worth generally increases with age as people build wealth over a lifetime. Persons in the 23 to 34 age cohort are likely to have entered into loans to purchase and furnish their future home (people in Malta are more likely to own a home than rent, with home ownership in 2014 standing at over 76%) and have most likely made the decision to raise a family. The 35 to 45 and the 45 to 54 age cohorts respectively are likely to have invested in bringing up their children and in paying off the mortgage. As the 2008 HBS data shows, it is at this stage, once the mortgage is paid off and the children secured their own income streams, that a household has the opportunity to start accumulating wealth (other than their residential home).

Source: https://sorted.org.nz/must-reads

Upon retirement, income decreases and whilst household patterns change, the ability to live a quality of life similar to that whilst in employment decreases as well. The above shows that, within the life cycle of an average person, there is only a limited period of 10 years where, apart from the investment in the home asset, that person or household starts to accumulate wealth in financial assets.

The Table below presents the Mean Household Wealth of Maltese Households at different stages of their lifecycle. This is based on a study carried out by the Central Bank of Malta (WP/04/2019).

| Mean Household Net Wealth - 2019 |

| Age | Euro |

| Under 35 years | 258,892 |

| 35-44 | 467,372 |

| 45-54 | 462,499 |

| 55-65 | 460,979 |

| Over 65 | 349,627 |