ĠEMMA regularly posts on the use of your credit cards. If you do not use your credit well you are likely to get caught up in financial issues – falling behind in payments, missing out on payments, paying higher interests, getting a negative credit rating amongst others.

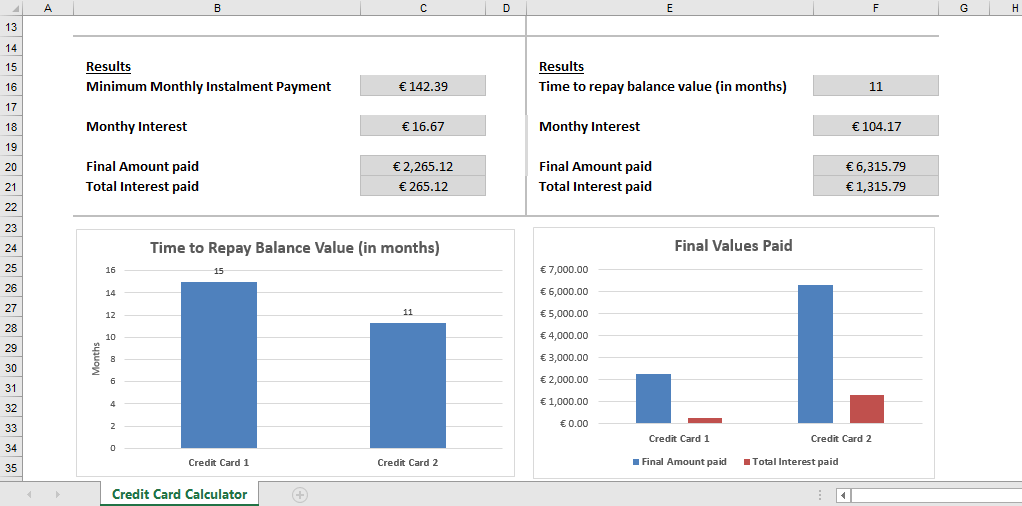

This calculator allows you to compare the use of two credit cards using two different key parameters. With Credit Card 1 the key parameter is the time you will take to pay the credit balance you owe. This parameter is shown in the first column. With Credit Card 2 the key parameter is the minimum monthly payment that you will make. This parameter is shown in the second column.

The calculator allows you find out which credit card works best for you. Perhaps, more importantly it allows you to find out what the impact is on decisions you make with regard how to pay the money you owe. So, for example, in the Credit Card 1 calculator you calculate the interest impact if you had to pay the money in 10 months. The calculator shows that to pay the credit owed in 10 months, you need to pay a monthly instalment payment of €209.28 including a monthly interest of €16.67 – with total payment being €2,173.06, of which interest is €173.06.

You may wish to calculate whether it would be a better decision if you pay a lower monthly payment so that you have more disposable income in hand – deciding on a €70 payment a month. You calculate this on Credit Card 2. The calculator shows you that this is an expensive option that will take you 33 months to pay off the credit balance. Total payment will reach €2,625.00 of which €625.00 interest.

The screen shot below demonstrates how these calculations are shown by the calculator.