If you have multiple debts – more than one credit card, home loan, car loan – have you ever wondered what strategy you are to adopt to pay off your debt. Earlier this quarter ĠEMMA posted a series of articles with regard to debt. These included tips to reduce the cost of your credit card debt, how to make best use of an overdraft, getting your debt under control, paying off your debt.

This post presents you with a calculator that will help you to play how to pay off and hence get out of debt.

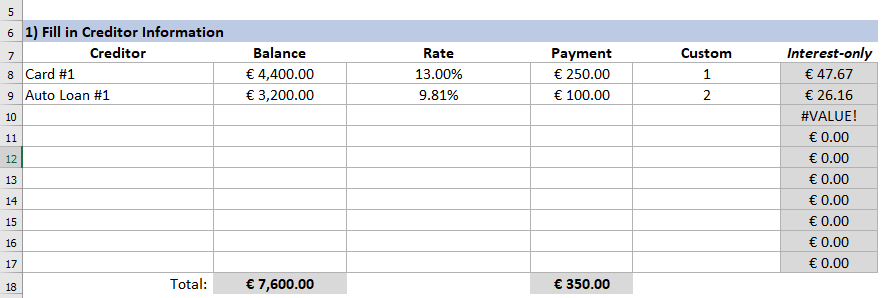

The calculator has 4 sections. The first section allows you to input your debtors, amount owned, monthly payment, your ranking of how you will pay off the debt, and interest paid.

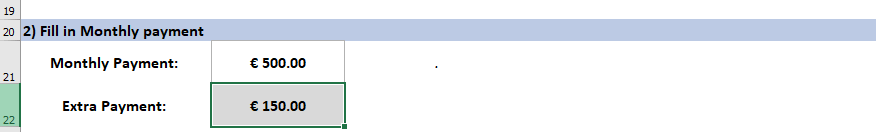

The second section allows you to input the monthly payment that you will put aside to pay off your debt – including any extra payments you may wish to add so that you clear your debt earlier.

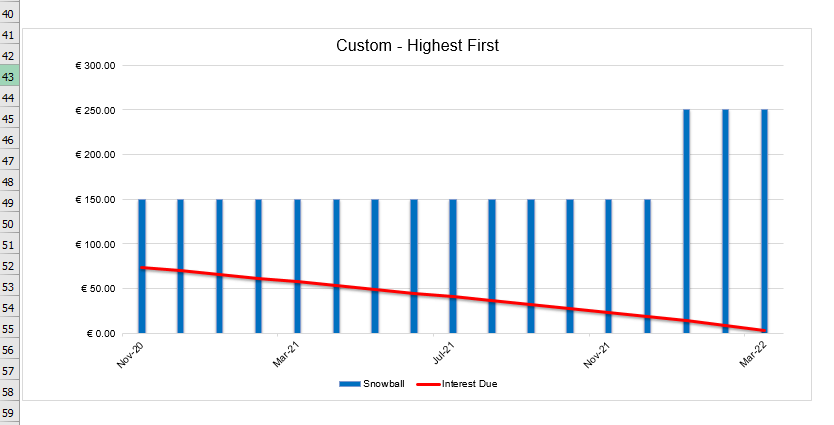

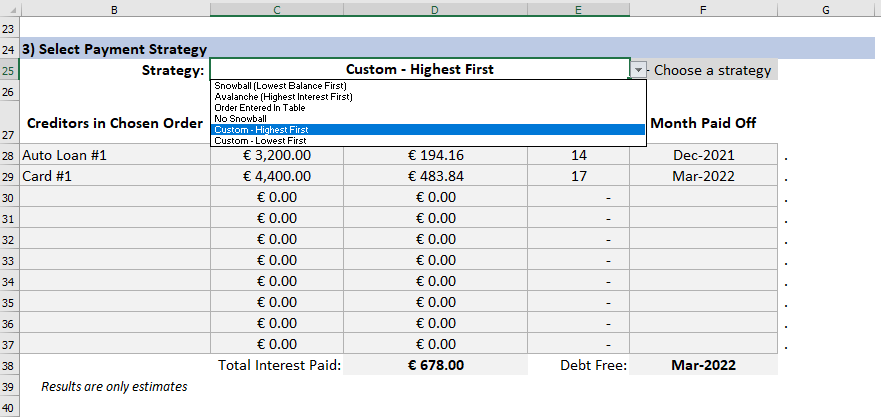

The third section allows you to chose your debt payment strategy. You do this by selecting the strategy you want to adopt as shown below. You have a number of options to choose from. This includes the ranking you would have set in section one (Customer) and you can categorise payment by highest and lowest amounts. A third option is payment made simply by the order you inserted the debts in the calculator.

The two other strategies – Snowball and Avalanche – refer to debt strategies discussed in an earlier post. To refresh:

| Snowball Method | Using the snowball method you pay off your debt by balance, starting with the smallest debt. This method works well if you need to stay motivated to keep blitzing that debt. | How it works: o Arrange your debt by balance owed, beginning with the smallest. o Then allocate funds to pay the minimum due on each account. o For the smallest account, see how much you can add to the minimum payment so that you eliminate it as soon as possible. o Once that debt is paid off (don’t forget to close it with your creditors) you can move on to the next debt. |

| Avalanche Method | The avalanche method focuses on paying off the debt with the highest interest first. This method is the most cost effective, efficient and fastest way to get out of debt but requires a lot more discipline. | How it works: o Arrange your debt from highest interest to lowest charged. o Allocate funds to pay the minimum due on each account. o Allocate extra available cash to the account with the highest interest rate and chip away at it until it’s done. Remember that interest is charged on your outstanding balance so reducing your balance sooner, reduces the amount of interest you pay. |

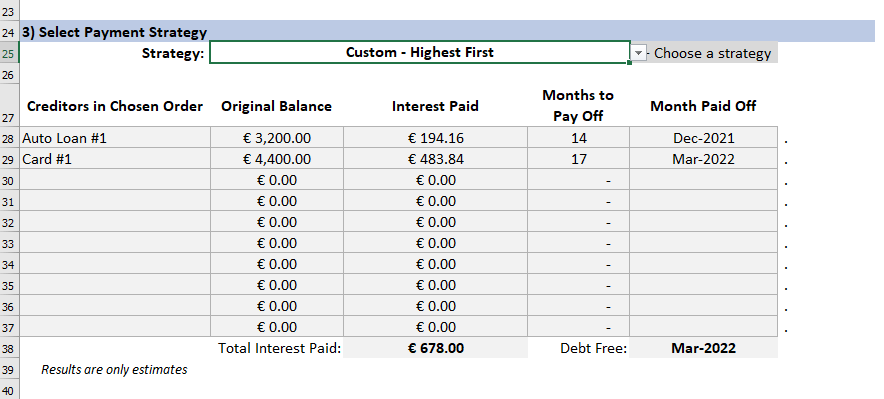

The fourth section calculates your debt repayment plan by interest to be paids, months to pay off, and when each respective debt is paid. In the example below, the Avalance debt strategy is selected.