This is part V of ĠEMMA’s series on Rules of Thumbs that act act as a useful and reliable steer which engages persons offers a better course of action than not following it is in the withdrawal of savings from your retirement pot.

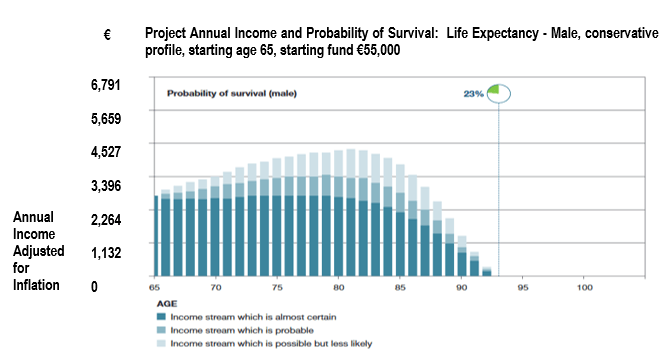

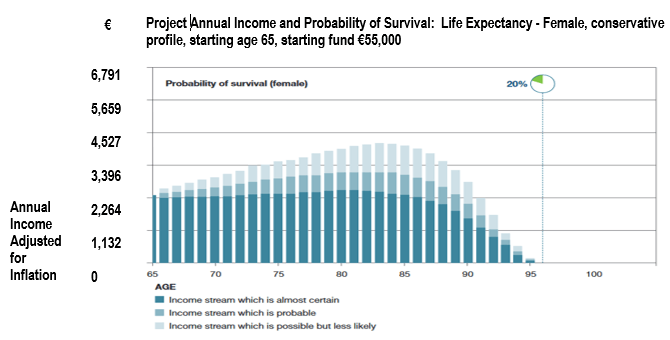

Today’s post explores the Life Expectancy Rule. This Rule sees you each year take out the current value of your retirement savings divided by the average remaining life expectancy at that time. This rule is tested for the following general case: person is retired; starts accessing the savings from their money pot at ages of 65, 70 and 75 years; has a balanced or conservative investment; and the ppension pot is assumed to be €55,000.

This works as follows:

- You calculate your income level each year using your expectancy. For example, a woman with her 70th birthday in 2020 would find a remaining life expectancy of 14.7 years (84.7 less 70), so the income to be taken that year would be €3,851 (100,000 divided by 14.7). Next year, the remaining fund would be divided by the current estimate of remaining life expectancy for a woman aged 71.

- You will withdraw the relevant amount from your pension pot whilst you are alive – but the payment becomes small if you live longer than expected at the point when you started to draw on your retirement savings and very small if you live significantly longer than average. As life expectancy reduces at older ages, the level of income falls quite rapidly. Annual income will vary because it depends on the investment return achieved and the life expectancy estimate which is recalculated each year.

- This Rule is suitable for people keen to aim at using nearly all their money during life with a guarantee of never quite running out.

- The calculation has to be managed each year.

| Most Suitable for | Pros | Cons | Inheritance |

| If you want to maximise income throughout your life, not concerned with inheritance. | Efficient use of your retirement money pot to provide income for whole of life. | Amount of income varies from year to year; low in later years. Annual calculation necessary and relatively more complicated. | Some inheritance normally paid; average inheritance amount moderate. |

The Rule of Thumb is tested. The following is to be taken into account:

- The income shown is adjusted for inflation.

- As investment returns in the future are uncertain, the income you will receive is uncertain. The dark income is income which you will almost certainly receive (at least 95% probability of receiving), the medium colour is additional income you will probably receive (at least 50% probability of receiving) and the light colour is further income you might receive (less than 50% probability of receiving

- The green pie-charts show the probability of surviving from age 65 to the age shown, allowing for typical New Zealand mortality experience. The following compares New Zealand and Malte life expectancy as per https://www.worldometers.info/demographics/malta-demographics/.

| Malta | New Zealand | ||

| Male | Female | Male | Female |

| 81.4 | 84.7 | 81.2 | 84.7 |