One particular term relating to credit cards that confuses the mind is the ‘Annual Percentage Rate’ – or as it is better known, the APR.

The purpose of this post is to de-mistify the APR. A credit card comes with an interest rate. This is the price you pay for borrowing money.

When you buy something with, or withdraw money through your credit card you are taking out a ‘loan’. Even if you pay the amount immediately you will still be charged an interest rate from the day you used the credit card to make a purchase until you paid the bank.

The APR is expressed as an annual rate credit card companies use to calculate the monthly interest rate. Because not all months have the same number of days the banks do not calculate the actual APR on 12 months but on 365 days.

What is important for you to note is that the higher the APR the more expensive will the cost of use of the credit card be. ĠEMMA strongly recommends that you make sure that you get a card with the lowest APR possible particularly if you think you will use the card extensively. If you are looking out for a credit card or your credit card is about to expire shop around for a card which has the lowest APR. We suggest that you use the MFSA Product Charges Comparison Tool.

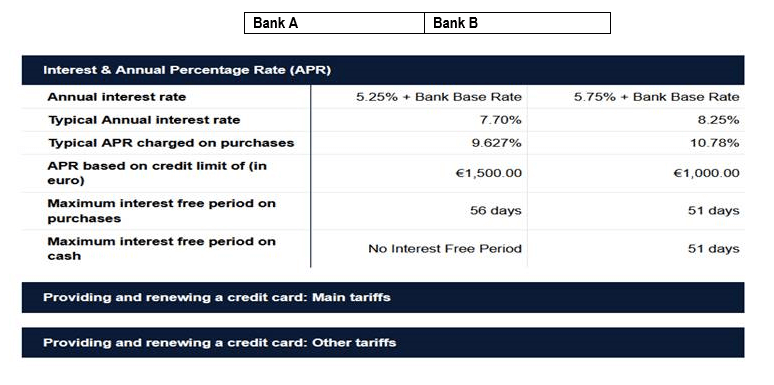

The picture below compares a classic VISA credit card that is provided by two different banks in Malta. This comparison is created by using the MFSA Product Comparison Tool. As you can see the Table below presents figures for both a ‘Typical Annual Interest rate’ and a ‘Typical APR charged on purchases’.

Too often in marketing a credit card banks emphasise the ‘Typical’ Annual Interest rate’. As you can see, however, with regard to both Banks the cost of the ‘Typical APR charged on purchases’ is higher by 2% than the ‘Typical Annual Interest rate’. The rate that you must take into consideration when applying for a credit card is the APR.