Interest is often thought of as the amount of money a bank charges you for a loan you take out. The term interest also refers to the income you earn on savings and investments.

There are different forms your retirement plan can take so that you build a retirement egg nest. You can save in government bonds – like the bonds The Treasury of Malta issues from time to time; in fixed term deposits at a bank; in shares, secured and unsecured loans at the Malta Stock Exchange as well as elsewhere; and more recently in a Personal Pension Plan.

All of these instruments are dependent on market behaviour. Government bonds are dependent on how credit agencies rate a government’s performance which influences a country’s interest rate on borrowing, (which is what bonds do). Markets, as the cliché goes, go down as well as up.

ĠEMMA advises that investments in shares, secured and unsecured bonds should only be made by persons who understand the financial market and the complex financial instruments it is made up of. Bank interest rates have for some time now been unattractive rendering little return on your investment.

The Personal Pension Plan regulatory framework introduced by the Government since late 2015 is an attractive mechanism that you should consider. It provides you with a tax credit of 25% up to an annual contribution of a maximum of €2,000. That is an attractive return. You will also receive a rate of return on your pension savings annually. In the current climate this may likely be between 2.5% and 3% annually.

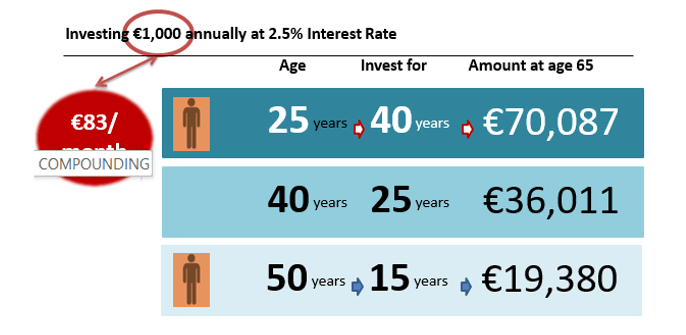

An important cornerstone of the Personal Pension Plan is that you cannot have access to the annual savings and the arising interests before you reach the age of 61 (and must be accessed by the age of 70 years). Thus from one year to the next interest is earned on the interest accrued in the previous year. In short, the interest compounds. Compound interests make investments, and money grows at a faster rate. The figure below presents an example. This example assumes that you will invest €83 monthly (€1,000) annually at an average interest rate of 2.5%.

As can be seen from the figure, the earlier you start your pension plan savings-investment, the greater is the retirement nest egg you will access on retirement. If you are 25 years old and you enter such a plan on your first job, and you intend to retire at the age of 65 years, on your retirement your investment will increase from €40,000 to €70,087*. As a result of the compound interest, your investment increased by €30,087 – or by 75%.

It is important that if you are in a position to do so, you start saving for your retirement at an early age. As important is that you educate your kids so that they too start saving for retirement early.

* Estimate depending on calculator used