It’s important to take the time to understand the various aspects and issues of retirement. A deeper understanding of retirement realities and current and future possibilities, taking into account our needs and wants, will enable us to have a better picture and successfully plan the best course of action for a comfortable retirement.

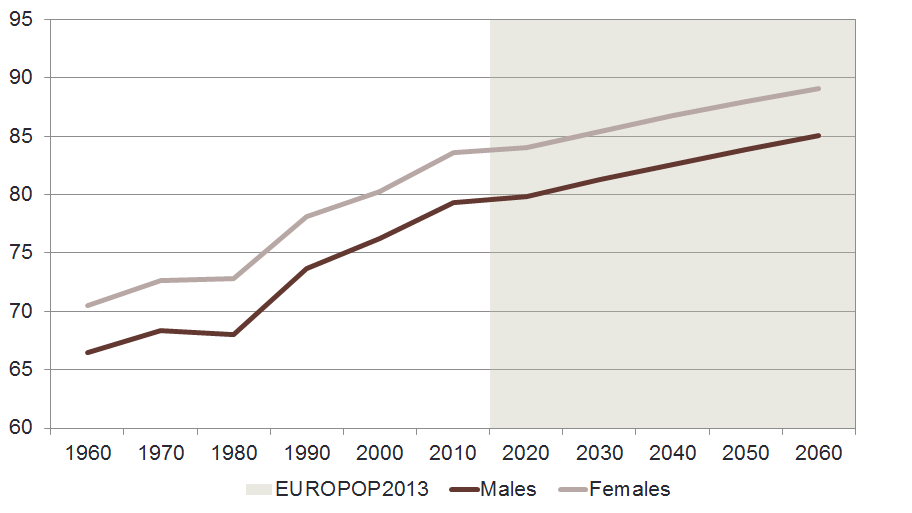

The life expectancy of Maltese persons continues to increase over time. There is no doubt that your retirement will last much longer than that of your parents. The risk is that you may under-estimate how long you will live when you plan your retirement and outlive your retirement savings.

You need not assume that life is equal to the life expectancy: you may live longer and if so, your savings must allow for the additional years that you live beyond the expected life expectancy. The graph below shows that women outlive men by 5 years with figures of about 79 years for men and 84 years for women.

Spouses and registered partners need to consider that unless they qualify for a social security contributory pension in their own right, in the event that their spouse/ partner passes away, they are not entitled to the full pension of their spouses but five sixths of their spouse/partner’s pension payment.

![]() Inflation represents the general sustained increase in prices resulting from demand for goods. Obviously, prices of selected goods may increase for reasons unrelated to inflation. A practical example being the cost of Maltese bread at €0.16 in 1992 to €0.92 during the year 2015. The difference in the selling price is 5.75 times more than the cost of a loaf of bread 23 years ago.

Inflation represents the general sustained increase in prices resulting from demand for goods. Obviously, prices of selected goods may increase for reasons unrelated to inflation. A practical example being the cost of Maltese bread at €0.16 in 1992 to €0.92 during the year 2015. The difference in the selling price is 5.75 times more than the cost of a loaf of bread 23 years ago.

As prices rise, wages and salaries also have a tendency to rise. However, money put aside, if not invested, will remain same in terms of hard cash but it’s value (worth) will not increase (no rate of return over time). Furthermore, unfortunately, a €100,000 planned retirement nest egg today will have a lower purchasing power in 10 years’ time as the cost of goods and services continue to increase. A measure to overcome inflation is to use more of our income today to put aside for tomorrow’s needs.

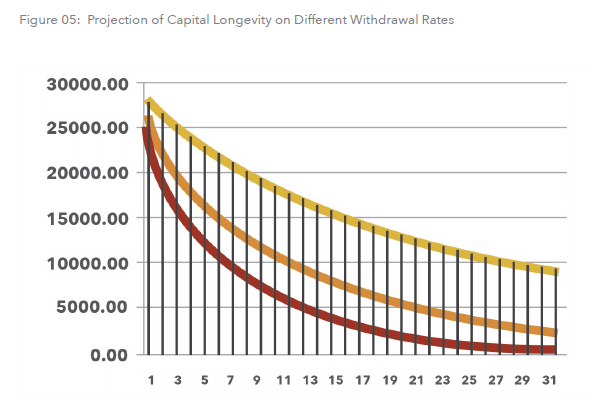

Not having enough income at retirement is not an option! Many factors, such as your rate of withdrawals, have an impact on your savings during this period. Too many withdrawals is likely to deplete your retirement nest egg. For example, a 1% decrease in your withdrawal rate could make all the difference in the world, as seen in the following chart.

Figure: Impact of Applying Higher Withdrawal Rates from Your Retirement Nest Egg

Example

The figure below shows the impact of different annual savings withdrawal scenarios – 15%, 10% and 5% – from your retirement nest egg.

Figure: Different Withdrawal Scenarios from Your Retirement Nest Egg

If you withdraw 15% annually your retirement nest egg will fall to below €1,000 by the time you are 86 years of age. On the other hand, if you withdraw 5% savings annually your retirement nest egg will be slightly below €10,000 at the same age.

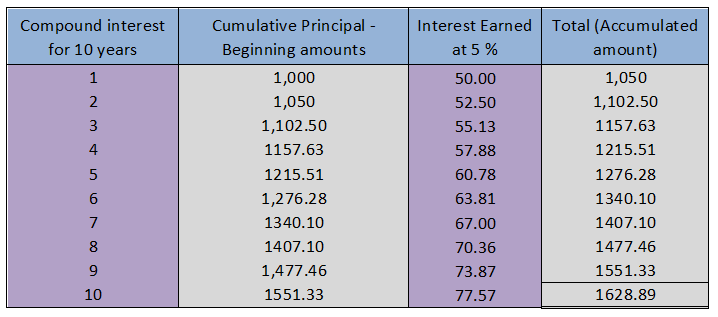

The concepts discussed so far can be combined to determine what decisions we need to make to invest. The tables below illustrate compound interest and simple interest in terms of money, depositing an initial investment of €1,000. The compound interest table is bolder.

Example 1: Compound Interest versus Simple Interest :

The compound interest table shows the interest that would be earned after a period of 10 years with an initial investment of €1000, at a compound interest rate of 5%. Apart from the initial investment, savings can accumulate with any monthly or yearly deposits, with any initial deposit and can start at any age. Imagine, therefore, how much more our investment can increase by the time we retire if we start saving at an early age and if there will be consistent investments.

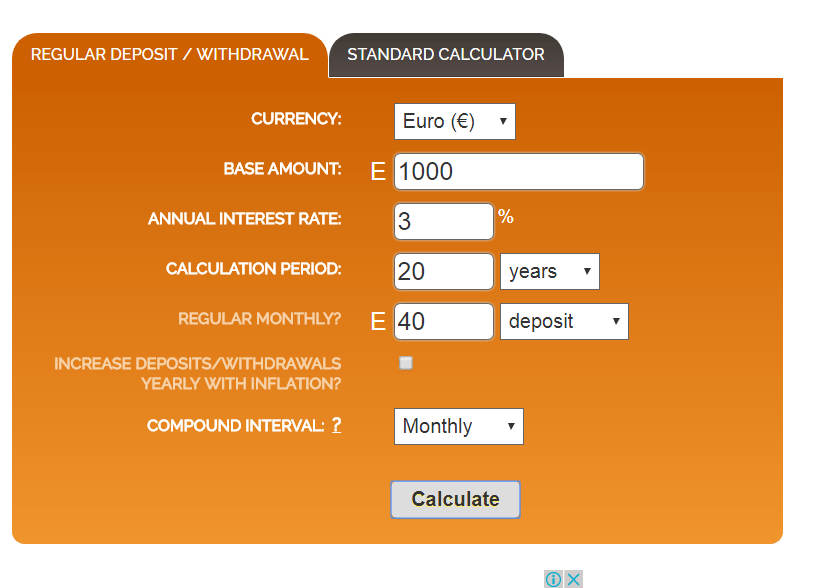

This online calculator demonstrates how to put this compound interest savings strategy to work for you to accumulate wealth. https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/compound-interest-calculator.

http://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

The online calculator gives you the opportunity to key the desired initial amount to be invested, the annual interest rate being offered by the provider, years to save, as well as any additional savings. The latter need to be calculated as monthly instalments. The amounts can be keyed in, in Euros.

Determination, no delays or postponement, and consistency are three components leading to an easy accumulation of wealth for your retirement nest egg. In addition, you have to be smart, you have to check out for different interest rates offered by well-established banks, and find the one that will give you the highest interest rate. Alternatively you can look at personal pension schemes provided by financial service providers. Such schemes provide you with further incentives like tax rebates simply because you started saving for your retirement.

Therefore, three steps need to be followed

(1) The amount of money you can really manage to put aside for long term use,

(2) The bank which offers the highest interest rates,

(3) Organising your deposits via a standing order where money is automatically deposited into your long term savings account on particular days.