Life Insurance companies generally offer two types of investment vehicles. These are called with profits investments and unit linked investments. But what are the main differences between these two?

With Profits

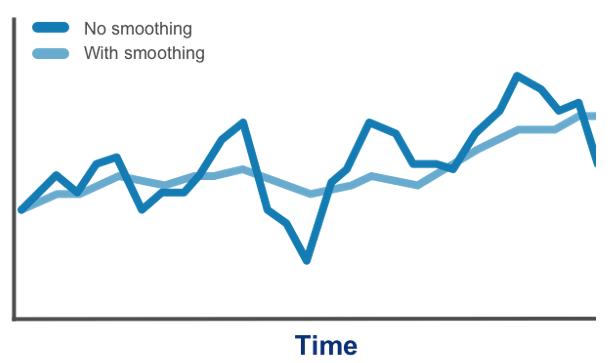

A with profits investment is generally a capital guaranteed investment and builds its value from annual bonuses paid by the insurance company. These bonuses are not guaranteed but once added to your policy, such bonuses cannot be removed. To help ensure the life assurance company can pay a bonus each and every year they normally hold back some of the profits in reserve so in the event the with profits fund performs badly they have enough in their reserve to still make a bonus payment. This is what is called smoothing of returns.

Unit Linked

In a unit linked savings/pension Plan, you can choose from a variety of funds offered by the insurance company and the value of your policy is linked to the value of these funds. Hence, the value of your policy can go up or down depending on the performance of the fund/s selected.

By Investing in such funds on a regular basis, you can take advantage of what is called “cost averaging”. This is where you are buying units at their troughs and peaks averaging out your overall price for each unit bought.

Main Differences

With a unit linked investment, you are completely open to market conditions as your investment value is directly linked to the value of the funds underlying it. A with profits investment, however, builds a guaranteed value over its term.