This is part IV of ĠEMMA’s series on Rules of Thumbs that act act as a useful and reliable steer which engages persons offers a better course of action than not following it is in the withdrawal of savings from your retirement pot.

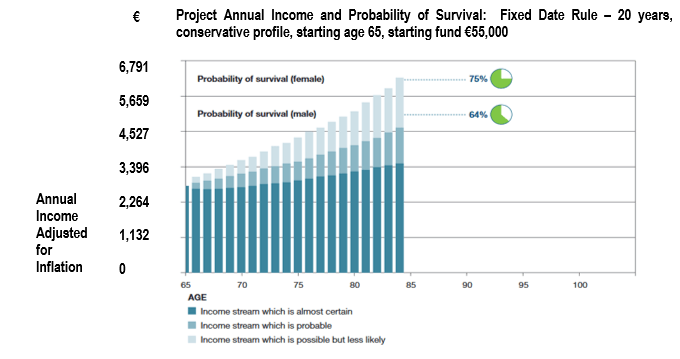

Today’s post explores the Fixed Date Rule. This Rule sees you run down your pension pot over the period to a set date – where-in each year you take out the current value of your retirement savings divided by the number of years left to that date. This rule is tested for the following general case: person is retired; starts accessing the savings from their money pot at ages of 65, 70 and 75 years; has a balanced or conservative investment; and the pension pot is assumed to be €55,000.

This works as follows:

- This gives an income level set by you on the basis of when you choose your pension pot to be exhausted. For example, the pension pot will give you €2,832 in the first year if you decide to run the fund down over 20 years.

- The amount you receive each year varies depending on the actual investment return earned up to that date, but the length of time you will receive an income from your pension pit is fixed.

- The annual income you received is the remaining value of your pension pot each year, divided by number of years left to the date you have decided that your pension pot will be exhausted. The annual income should increase in real terms as the investments grow, but may fall.

- This Rule of Thumb is suitable to you only if you are comfortable with the income amount being uncertain and varying each year and that you are comfortable in relying on the Social Security Contributory Pension or other sources of income you may have after you exhausted your pension pot.

| Most Suitable for | Pros | Cons | Inheritance |

| You are comfortable with living on your Social Security Contributory Pension and other income after when you exhaust your pension pot. You want to maximise income throughout life, not concerned with inheritance. | Income for a known selected period. | Amount of income varies from year to year. Annual calculation necessary. | Lowest average inheritance amounts. High probability of no inheritance, especially if selected date to exhaust your pension pot is age 85 or earlier. |

The Rule of Thumb is tested. The following is to be taken into account:

- The income shown is adjusted for inflation. This is why this Rule gives an amount which increases with inflation each year, appears flat. If the income looks level from one year to the next that means it will be a higher number of Euros in future, but will have the same spending power as today.

- As investment returns in the future are uncertain, the income you will receive is uncertain. The dark income is income which you will almost certainly receive (at least 95% probability of receiving), the medium colour is additional income you will probably receive (at least 50% probability of receiving) and the light colour is further income you might receive (less than 50% probability of receiving

- The green pie-charts show the probability of surviving from age 65 to the age shown, allowing for typical New Zealand mortality experience. The following compares New Zealand and Malte life expectancy as per https://www.worldometers.info/demographics/malta-demographics/.

| Malta | New Zealand | ||

| Male | Female | Male | Female |

| 81.4 | 84.7 | 81.2 | 84.7 |