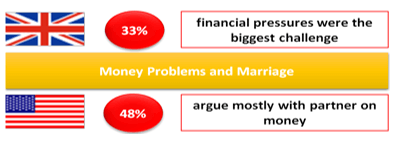

A study in the UK by Slater and Gordon, carried out in 2018, found that money worries top the list of reasons married couples split up. Over a third of those questioned said that financial pressures were the biggest challenge to their marriage, while a fifth said most of their arguments were about money. One in five polled blamed their partner for their money worries, accusing them of overspending or failing to budget properly. A survey carried out by The Cashlorette in 2018 in the US found that nearly half of Americans (48%) who are married or living with a partner say they argue with the person over money. Most of those fights are about spending habits, with 60% saying that one person spends too much or is too cheap (https://www.moneyforthemamas.com/).

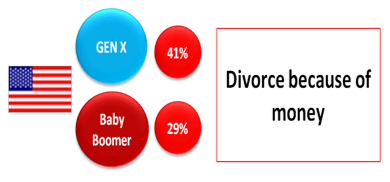

The remaining fights are pretty evenly split between someone being dishonest about money, how to divide the bills and other types of money fights, which could be anything from disagreements over forgetting to pay a bill to a couple’s financial priorities in life. Data released by financial firm TD Ameritrade found that 41% of divorced Gen Xers and 29% of Boomers say they ended their marriage due to disagreements about money (https://www.marketwatch.com/).

A study titled ‘Examining the relationship between financial issues and divorce by Sonya Britt and Sandra Huston concludes that if you argue about money early on in your relationship, watch out: That may be the No. 1 predictor of whether or not you will end up divorced.

Why is this so? Disagreements about money are one of the most challenging conflicts for people in relationships to resolve.

Bringing up money with family can be uncomfortable and even be seen as taboo because it is not a normal conversation that’s brought up. And there is a good reason for this: money and stress very often go hand in hand, whether it’s because of an overextended budget, an unexpected financial emergency, or even the discovery of your spouse’s secret credit card. And if your personal or financial circumstances change, it is even more critical to make sure that you keep talking to each other about how you will manage the transition and how you feel about what you are going through.

There’s little instruction on how to manage our finances with a spouse or partner. And if you do it wrong, it can mess everything up. A study by Lauren Papp, a psychologist and professor at the University of Wisconsin, Madison, found that money can be one of the most challenging and damaging areas of conflict. Part of the problem is that it’s tough for couples to talk about money issues and resolve them, “and partners walk away from these discussions learning this is an issue we can’t handle; I feel very frustrated, I feel very devalued by my partner,” Papp says (/www.npr.org).