To be financially healthy it is very important that you keep your debts to a level that you can afford. Life, unfortunately, is not a straight line. There will be moments when your financials are suffering – and you must make sure that when these moments occur you can manage your debts.

To find out use the ĠEMMA My Debt Affordability Calculator.

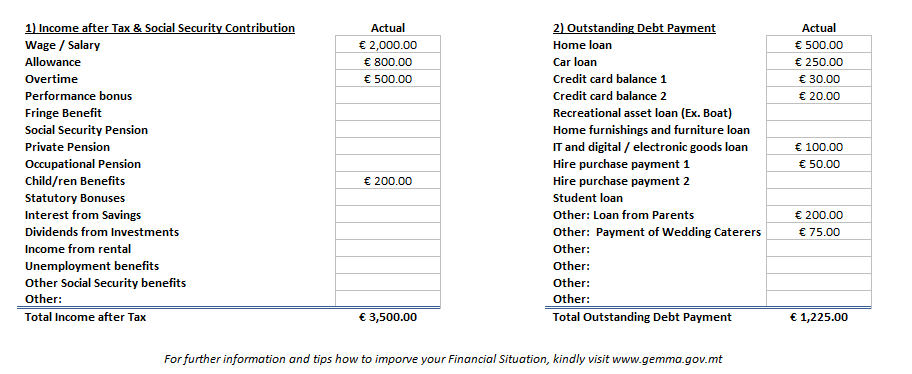

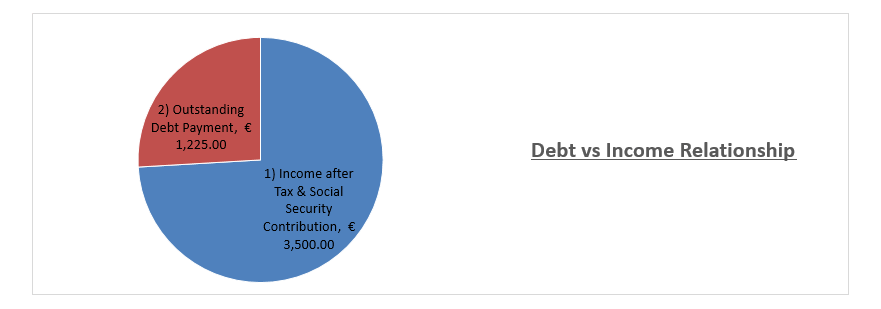

Technical your level of debt affordability is known as the ‘debt to income ratio’. To determine your level of debt affordability you are to list all of your disposable income ( that is you income after deducting the income tax and social security contributions payments) and all of your debts. Examples are shown in the Table below:

| Disposable Income | Outstanding Debt Payment |

| Wage / Salary | Home Loan |

| Allowance | Car Loan |

| Overtime | Personal Loan |

| Performance | Credit Card |

| Fringe benefit | Hire Purchase |

IF YOUR LEVEL OF DEBT AFFORDABILITY IS:

| 21% to 35% | You are exposed |

| 36% or higher | You are in trouble |

If your level of debt affordability is 36% or high take the following steps:

- Avoid taking on more debt.

- Make sure you first pay the debt on your essentials – the mortgage on your home – first.

- There after make sure you pay the debt with the highest interest rate and Annual Percentage Rate (APR).

- See whether you can increase your income so that you can pay off more of your debt.