In March 2020, ĠEMMA launched a series of six surveys to understand household money management behaviour within the context of COVID-19. The 6th survey in the series was held in March 2021.

Click here to download the 6th ĠEMMA Pulse survey on Household Money Management

On Thursday 29th ĠEMMA held a Webinar on this survey. The panellists included Ms Abigail Mamo, CEO of the Chamber of SMEs, Mr Josef Bugeja, Secretary-General of the GWU, and Mrs Stephania Sant Dimech, CEO of the Richmond Foundation.

Scroll below to watch the 6th Pulse Survey on Household Money Management Webinar

The report of the 6th survey is attached. In this report, the responses attained over the 6 surveys are compared. Of particular note are the following:

- With 86% responses (March 2021), overall the general public feels that it is in control of their financial situation.

- 41% plan out monthly expenditures by making a budget.

- 44% of the population tends to worry about their financial future.

- Following their experience of the crisis brought about by the COVID-19 pandemic, in March 2021 21% of respondents noted to be more inclined to save for a rainy day once things return to normal.

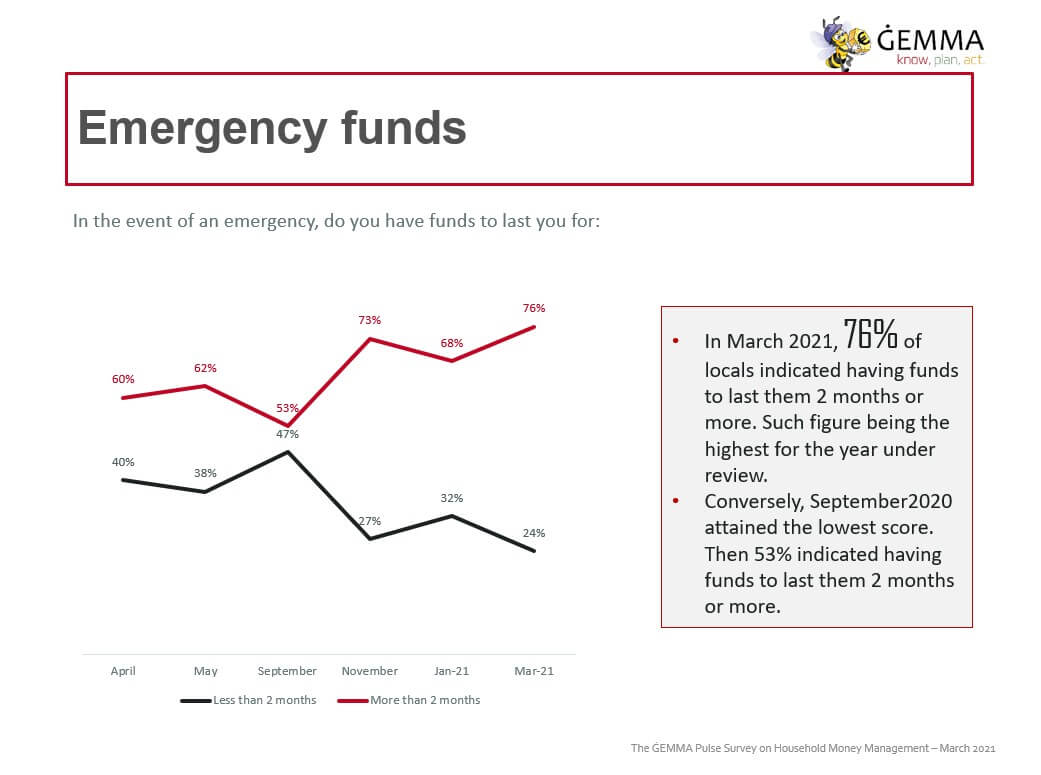

- In March 2021, 76% of locals indicated having funds to last them 2 months or more. Such figure

- In March 2021 63% of respondents indicated that they have been able to save over the past three months. In April 2020 the majority of respondents indicated that they were not able to save.

- 79% of respondents do not have a retirement pension plan over and above that provided by the government.

Overall, 5% of the population tends to read up on personal financial matters.