ĠEMMA on 7rd November held a webinar on key matters that one should be aware of with regards to Household Money Management.

The panel consisted of Josef Bugeja – Secretary General of the GWU; Abigail Mamo – CEO of the Chamber of SMEs; Frans Camilleri – Economist; and David Spiteri Gingell – Team Leader, ĠEMMA.

Mr Ramon delivered a presentation on the key findings from the survey.

Amongst the key matters brought up by Mr Ramon Muscat and discussed at the Webinar are the following:

- Maltese and Gozitan persons feel that they are in control of their current financial situation, with 84% answering in the affirmative. No distinct variances were observed when analysing data by gender and age. Such figures are in line with previous studies.

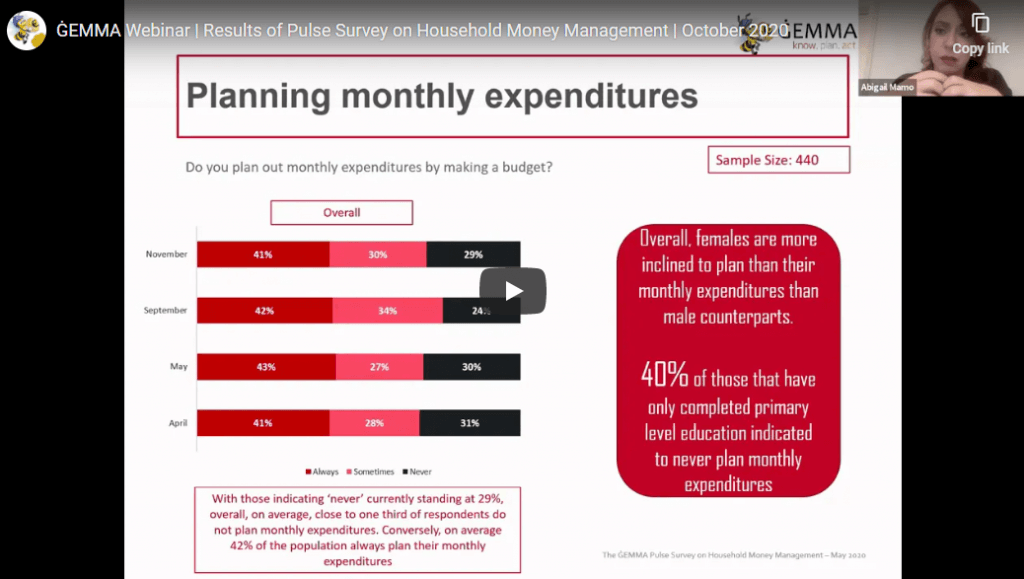

- Respondents tend to plan out monthly expenditures by making budgets (41% always and 30% sometimes). Conversely, 29%of the population do not plan monthly expenditures. Such figure representing a marginal increase from previous study (24% in September) though in line with previous waves (31% in April and 30% in May).

- 62% of respondents indicated having funds to last them more than 3 months. This figure represents a considerable increase over previous studies – and could imply that the pandemic has instigated individuals to spend less and save more (47% in April, 44% in May and 36% in September).

- 56% of the population does not think that now is the right moment for people to make major purchases such as furniture, electrical/ electronic devices, etc. This figure is in line with September figures, and illustrates that people are still marginally more cautious than they were back in May (then 50%), though still lower than April results (68%).

- 57% of respondents indicated that they have been able to save over the past three months; an increase of 8% over September results.

- 52% of the population tends to worry about their financial future (with 20% indicating to worry very much). No noticeable variances were observes when analysing replies with the previous studies.

- 63% of those aged 25 – 54 worry. Furthermore, in all studies, those aged 65 and over were the least to worry.

- 21% of respondents have a retirement pension plan over and above that provided by government. This figure representing no significant variance from previous studies.

- In line with the previous study, the vast majority of those without a plan indicated no likelihood of them starting a pension plan over the next 3 months.

- Overall, 50% of respondents consider themselves to be knowledgeable on money matters (10% ‘highly knowledgeable’ and 40% ‘slightly/quite knowledgeable’. Such figure being in line with September results.