In last Tuesday’s post ĠEMMA referred to the importance of following successful Rules of Thumb that nudge and guide persons to reach financial and money management decisions. One important area where Rules of Thumb act as a useful and reliable steer which engages persons offers a better course of action than not following it is in the withdrawal of savings from your retirement pot.

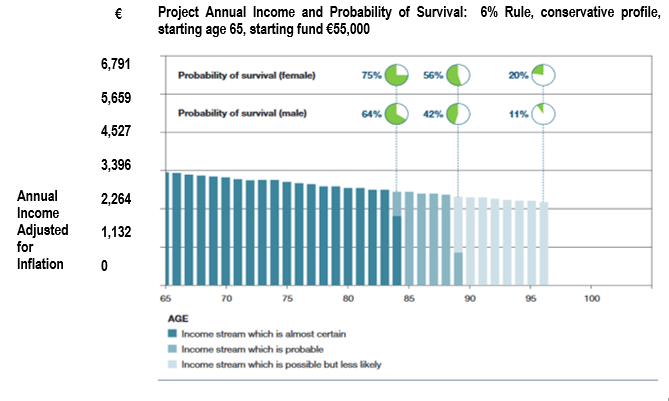

Today’s post explores the 6% Rule. This rule is tested for the following general case: person is retired; starts accessing the savings from their money pot at ages of 65, 70 and 75 years; has a balanced or conservative investment; and the pension pot is assumed to be €55,000.

The 6% Rule

This works as follows:

- Each year, you take 6% of the starting value of your pension pot.

- This gives you an annual income of €3,300 in nominal terms, which means the income decreases each year in real terms.

- You receive the same nominal amount each year – but the length of time you receive it for varies depending on the actual investment returns received.

- This Rule of Thumb is suitable for you if want a regular known amount of income each year, with a higher real income at the start of your retirement but there is a reasonably high change that your pot will run out before you die.

Pros and Cons of the 6% Rule of Thumb

| Most Suitable for | Pros | Cons | Inheritance |

| If you who want more income at the start of their retirement, to “front-load” their spending, and not concerned with inheritance. | Very simple. | Income will not rise with inflation. | Average inheritance low if drawdown commences at age 65; larger if it commences at a later age. |

This Rule of Thumb is tested. The following is to be taken into account:

- The income shown is adjusted for inflation. This is why this, which gives a flat income of €3,300 per annum, appears to fall over time – because the €3,300 per annum will buy less over time due to inflation.

- As investment returns in the future are uncertain, the income you will receive is uncertain. The dark income is income which you will almost certainly receive (at least 95% probability of receiving), the medium colour is additional income you will probably receive (at least 50% probability of receiving) and the light colour is further income you might receive (less than 50% probability of receiving

- The green pie-charts show the probability of surviving from age 65 to the age shown, allowing for typical New Zealand mortality experience. The following compares New Zealand and Malte life expectancy as per https://www.worldometers.info/demographics/malta-demographics/.

| Malta | New Zealand | ||

| Male | Female | Male | Female |

| 81.4 | 84.7 | 81.2 | 84.7 |