IMPORTANT. The information below has been superseded with newer information, and therefore please note that the information below may no longer apply. Kindly refer to https://socialsecurity.gov.mt/en/ for the most up-to-date information.

ĠEMMA on 3rd November held a webinar on key matters that one should be aware of with regard to the social security contributory system. If you missed the Webinar and you wish to view it click here.

Missed the Webinar … Do you want to go through it?

Click here to download the presentation delivered by Ms Pace, an Assistant Principal at the Department for Social Security and the Portal Manager of gemma.gov.mt.

Ms Pace, an Assistant Principal at the Department for Social Security and the Portal Manager of gemma.gov.mt delivered a presentation on key matters relating to the social security contributions system.

Amongst the key matters brought up by Ms Pace and discussed at the Webinar are the following:

- Whether you are an employee or a self-employed person if you are in employment you pay a social security contribution.

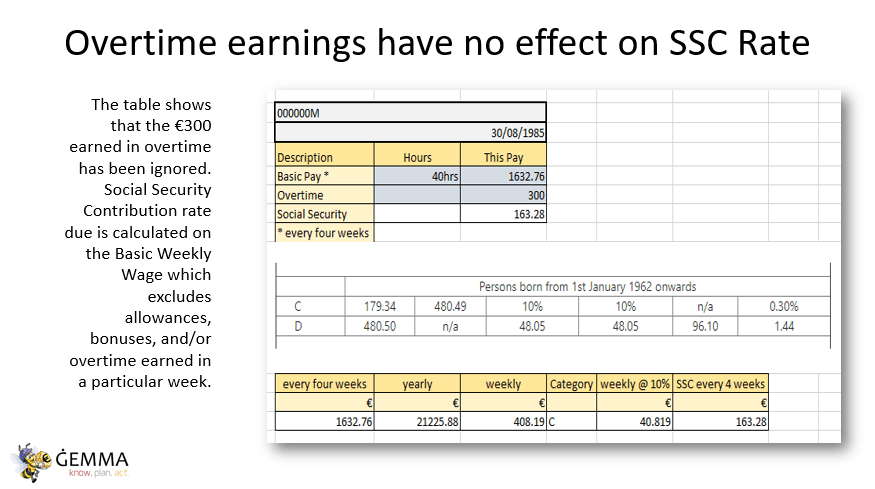

- The social security contribution you pays depends on when you are born. If you are born between 1952 and 1961 than the social security contribution paid is to a maximum of €19,017 and if you are born in 1962 and after, the maximum on which you pay the social contribution is €24,986.

- If you are an employee the contribution you pay is 10% and is calculated on the gross wage earned. On the other hand, if you are self-employed the contribution you pay is 15% and is calculated on income earned.

- Contrary to general perception, the social security contributory systems does not include only the retirement pension. It is in fact an ‘insurance’ and up to 1987 was known as the National Insurance system. As an insurance it provides you with an invalidity pension if you injure yourself, a widow’s pension if the spouse passes away before retirement, a survivors pension if the spouse passes away after retirement, and short term benefits such as sick leave, unemployment benefits, and the annual bonuses.

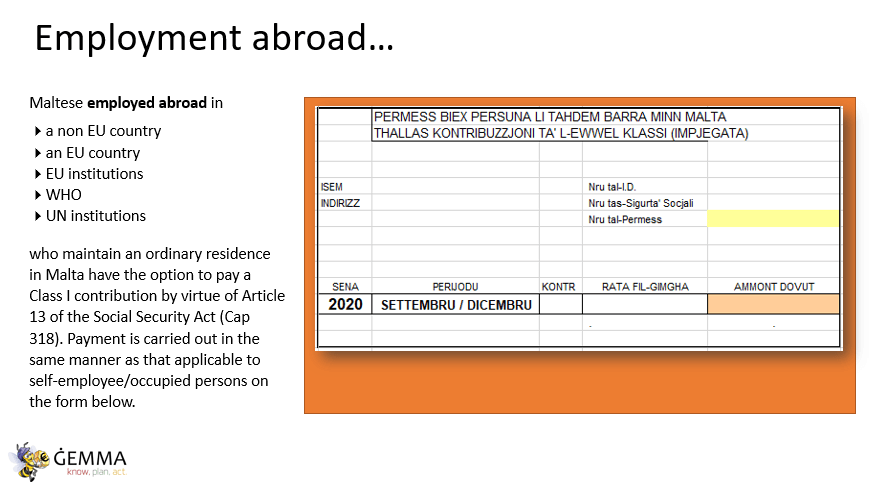

- The social security contributory system part-timers, exemptions, those who work abroad, those who take up early retirement schemes, (also known as voluntary retirement schemes), and Credits. Credits are contributions paid by the government when a persons takes time off employment on matters which are considered to be of national interest – such as credits for child rearing.

- Primarily amongst self employed persons, the social security contributions are seen as a tax and thus they under declare the income earned so that they paid a lower contribution – not realising that these means a lower pension when they retire.

- A person who is in employment and between the ages of 16 and 65 must pay Social Security contributions to the government.

- Social Security contribution was traditionally known as ‘il-bolla’ and used to be represented by a stamp fixed to a person’s workbook showing the number of contributions paid. Nowadays, Social Security contribution is abbreviated to SSC (Social Securing Contribution) or NI (National Insurance). Those working less than 8 hours in a week, are not considered for insurable employment for Social Security contribution and are exempt from paying Social Security contribution.

- Each annual contributory period to be considered as a full year is either 52 or 53 Social weeks depending on the number of Mondays within the year.

- Both employed and self employed persons can pay unpaid contribution so that they have a full contributory history. This depends on a person’s age: 35 years if born between 1952 and 1961; 40 years if born between 1962 and 1968; and 41 years if born on and after 1969.

- Exemptions from contributions are applicable for employees who work less than 8 hours a week and whose annual earnings do not exceed 910 euros.

Mr Josman Delmar, from the Department of Inland Revenue, explained that role of the Commission’s concerns collecting social security contributions from the employer. He focused on the importance of the FS3’s and reiterated the necessity of all FS3 to be retained by employees. The aim of the Commission is to ensure employees receive their FS3 from their employer. However, if an employer defunct’s paying employee social security, the commission would be forced to take specific actions such as financial penalties and legal action against the employer.

Mrs Matilde Balzan Cordina, participated in the webinar by sharing her life experience and views on the importance of paying social contributions. Mrs Balzan Cordina worked as a teacher before retirement and continued working part-time afterwards. She spoke about the benefits of having a pension as well as the other social benefits she is entitled to. Her perspectives and difficulties opened up the Q/A to the audience.