Prior to investing your savings into a private retirement pension product or any other savings or investment product, it is important that you think carefully about your unique needs and overall financial situation. This will allow you to determine whether the investment is right for you. The following are matters you should take into account:

You should consider the amount of debt you have prior to investing. This includes mortgages, hire purchase, car loans, and credit cards. Lines of credit with high interest rates and high payment amounts may reduce your ability to meet additional unexpected expenses. Consider whether it makes more sense to you to pay off your debts first prior to your starting to save for your retirement egg nest particularly if the interest rates you are paying are higher than the return you are projected to receive from the rate of return you expect to receive from your pension savings plan.

Ideally, before any investment, you should discuss your current liabilities and financial needs with your financial advisor.

Your income needs are important factors to consider. Most of us have a limited income stream – mainly our employment income, and any investment decision should be taken after a reflection of how that investment would affect the fulfilment of current, future and unexpected needs. You should, therefore, ask yourself the following questions:

- Will I be able to sustain this investment of over time?

- If there are changes to my current income situations, can I prioritise my habits and eliminate some to continue to sustain this investment?

- Will I have access to these funds in case of an emergency?

- Will I be saving in the pension plan over and above what I currently saving or will I be drawing the contribution payments from my savings?

It is important that you prepare yourself for changes in interest rates and market conditions that may affect your income stream. Whilst these today are low – they have not always been so. Thus, as interests may increase you may find that the interest on your home loan may start to increase and thereby limiting any disposable income that you would have placed aside to save into your pension plan.

Normally pension plan providers offer you the choice that you select between different categories of portfolios designed to reflect your risk appetite: cautious, balanced, and aggressive in terms of returns on investment. Choose the category that is best suited for you. If you are unsure, initially ask the provider whether they have what is known to be a ‘default fund’ – a cautious biased fund that is managed for you to reflect risks across your life journey: for example as you get closer to retirement the provider will make sure that your investment is glided to less risk investment choices such as secured bonds, government bonds, and cash.

The provider may also ask you whether you wish to manage your investments in your pension plan yourself. ĠEMMA strongly advises you that you do not opt for this option if you do not have a good understanding of the financial market and how it works.

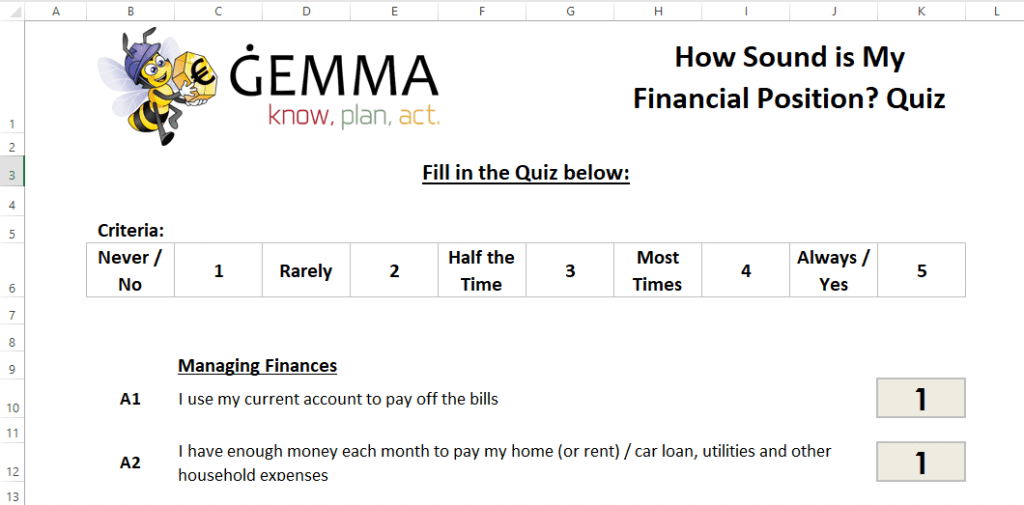

To check out the most appropriate mix for you and your situation (often called your “risk profile”), download the ĠEMMA Risk Profile Quiz from this link.