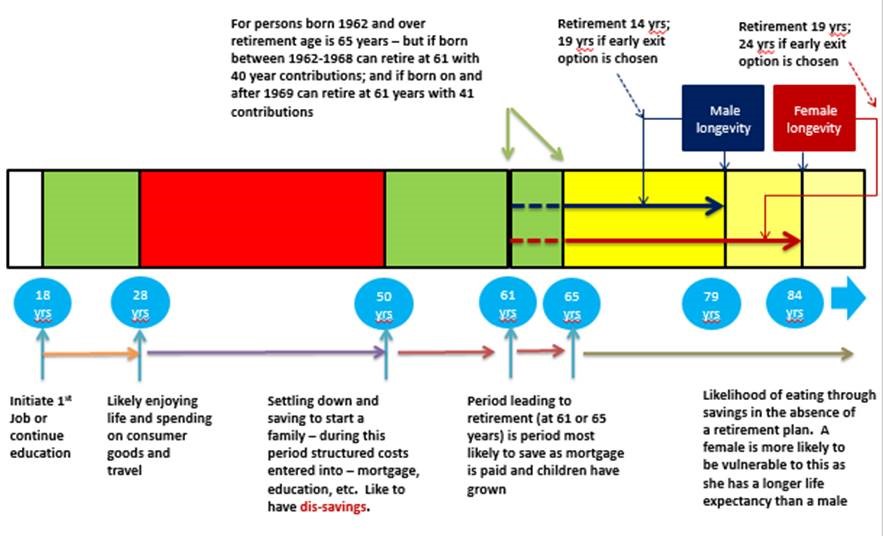

Before, life expectancy was such that enjoying a long retirement was not possible. In fact in 1960, the life expectancy of a Maltese male person was of 66 years, whilst that of a female was 71 years. Today, in 2020, the life expectancy is 79 years for males and 84 years for females. We are living longer, which means that we need to plan early if we are to have a retirement that allows us to enjoy a quality of life that is similar to that enjoyed whilst we were in employment.

In 1960, a male used to retire at 64 years of age. Today, a person retires at 63 years of age. This means, in 1960 the average retirement period for a person was 5 years, whilst today it is 17 years. It will reduce further in 2027 to 14 years, when a person will start to retire at 65 years of age. Still, that’s a retirement period that is 9 years over and above than that of a male who retired in 1960.

It is important to note that life is not a straight journey. You will go through a number of milestones. These are shown in the Figure below. You may start working at the age of 18 years or when you finish further or higher education. On receiving your first income you want to aspire for all those ‘wants’ you had to go without – car, travel, gizmos to mention a few. At a point in time you may get serious with a partner – plan to live together, buy a house, and have kids.

The period from when you buy a house and pay off the loan and raise your children until they fly the nest are the most expensive investment milestones of your life. For most, this will be at least 20 years. During this period you will perhaps manage to save money but not as much as you wish as you are every month paying your home loan, the kids’ education fees, etc.

Data indicates, that on average a Maltese household would have paid the mortgage and education related expenses by when you are 50 years of age. This is the time when your disposable income suddenly increases – as there is no monthly mortgage to pay or hefty education expenses. During this period you may wish to spurge for all those things you missed out when you did all those sacrifices to have a home and ensure your kids are educated. Yet, at 50 years of age, with, perhaps limited savings and investments, this is the time when you can start putting some serious savings to prepare for your retirement. Indeed, with 15 years to go to retirement you are already cutting it very fine.

It is important for you to note that if you earn a gross wage that is higher than €25,000, when you will retire your pension income will not be 66.6% of your wage – the 2/3rds commitment made when the pension system was introduced in 1979. Why this is so will be explained in the forthcoming post. You will receive less, and the higher your wage the greater the difference between the income you earned in employment and your pension income. This is because our pension system is not designed to secure as a minimum a gap possible between your employment and retirement income. It is designed to provide you with an adequate income sufficient for your retirement needs complemented by free health, Karta Anzjan, free medication, etc.

It is important that if you are in a position to do so, you should start saving for your retirement at an early age. As important is that you educate your kids so that they start saving for retirement early. Note that saving €83 monthly for 40 years from the age of 25 years will, as a result of a cumulative interest rate of 2.5%, give that person a retirement nest egg of €70,000 or so.