To enjoy your retirement, you need a well-thought-out plan. The big question : Where do you start from? For many, retirement is a long way ahead, for others their main concern is how to manage till the end of the month, stretching out their pay, with retirement being the least of their concerns.

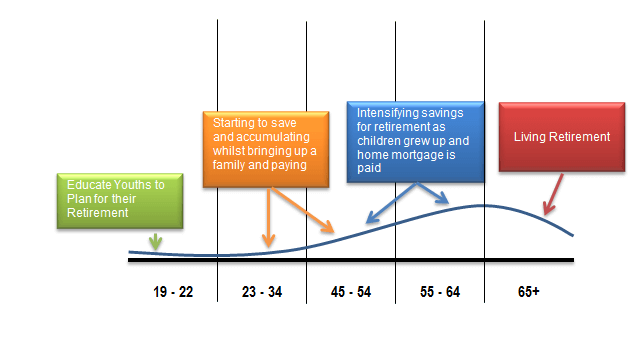

No two people have the same saving habits or goals or generate the same income; yet, some phases of the life cycle remain identical for most people. The chart below shows the life cycle of the average family.

A glance at the chart shows that the average family is likely to save for retirement in their late 40s or early 50s when they would have settled their mortgage (in case of a home loan) and when their children are old enough carrying out further post-secondary studies or are actually working.

In these scenarios, the average family has between 10 to 15 years to prepare for their ideal retirement – if they plan to retire between 61 and 65 years of age. The time period where money is added to the annuity will decrease and thus, the family will need to figure out how much more money they need to save for a decreased time frame to accumulate savings.