Jekk nifhmu l-kunċett tal-immaniġġar tal-flus fis-snin bikrin tal-iskola jkun pass fid-direzzjoni t-tajba biex jiġu stabbiliti karatteristiċi fundamentali ewlenin matul ħajjitna. L-ewwel logħba li tiġi f’moħħok meta titkellem dwar l-immaniġġjar tal-flus hija Monopoly. Il-logħba popolari fejn il-plejers jixtru u jinnegozjaw proprjetà, jiżviluppawha, jiġbru ħlasijiet tal-kirja u jippruvaw iġiegħlu lill-avversarji jfallu. Anke l-Monopoly Jr għat-tfal tgħin biex isaħħaħ il-matematika bażika waqt li tgħallem dwar l-ibbaġitjar.

It-tfal ta’ kull età jistgħu jużaw il-logħob biex jitgħallmu dwar l-immaniġġjar tal-flus u t-teħid ta’ deċiżjonijiet finanzjarji. Kunċetti li jiġu mitgħallma waqt il-logħob jgħinu lit-tfal jifhmu l-kawża u l-effett, jagħmlu żbalji, u jiġu ppremjati għal deċiżjonijiet tajba. It-tagħlim ibbażat fuq il-logħob huwa mod impenjattiv u effettiv biex l-istudenti jiġu mgħallmin u jista’ jkun utli b’mod speċjali għat-tagħlim ta’ kif jimmaniġġjaw il-flus minħabba li jagħti s-setgħa lit-tfal biex jitgħallmu mid-deċiżjonijiet tagħhom stess.

ĠEMMA tidentifika l-gamifikazzjoni għall-edukazzjoni dwar il-kapaċità finanzjarja bħala estremament importanti u essenzjali. Hi wettqet riċerka konsiderevoli biex tara jekk il-logħob eżistenti f’ġurisdizzjonijiet oħra jistax jiġi mmodifikat għall-użu lokali. Madankollu, dan ma kienx possibbli peress li l-biċċa l-kbira tal-logħob huma bl-Ingliż u ma jsegwux il-munita ewro. Għalhekk, ħafna kunċetti mhumiex allinjati mal-politika Maltija. ĠEMMA, għalhekk iddeċidiet li timla din il-lakuna billi tingħaqad mal-Università ta’ Malta fejn wieħed mill-għanijiet ewlenin tal-Memorandum ta’ Ftehim kien li d-Dipartiment tal-Intelliġenza Artifiċjali jgħammar lill-istudenti tiegħu bl-għarfien prattiku u applikat sabiex tinbena sħubija kollaborattiva b’saħħitha fejn l-enfasi ewlenija kienet fuq l-edukazzjoni tal-pubbliku ġenerali fit-tisħiħ tal-għarfien tal-kapaċità finanzjarja tiegħu permezz tal-gamifikazzjoni.

Dan huwa l-kunċett wara l-logħba Money Monsters. Din inħolqot minn tliet studenti fl-aħħar sena li kienu qed jistudjaw fid-Dipartiment tal-Intelliġenza Artifiċjali fl-Università ta’ Malta. Money Monsters hi l-ewwel riżultat ta’ Memorandum ta’ Ftehim bejn il-Ministeru għas-Solidarjetà u l-Ġustizzja Soċjali, il-Familja u d-Drittijiet tat-Tfal u l-Università ta’ Malta biex jintroduċi l-kunċett ta’ gamifikazzjoni fil-litteriżmu finanzjarju.

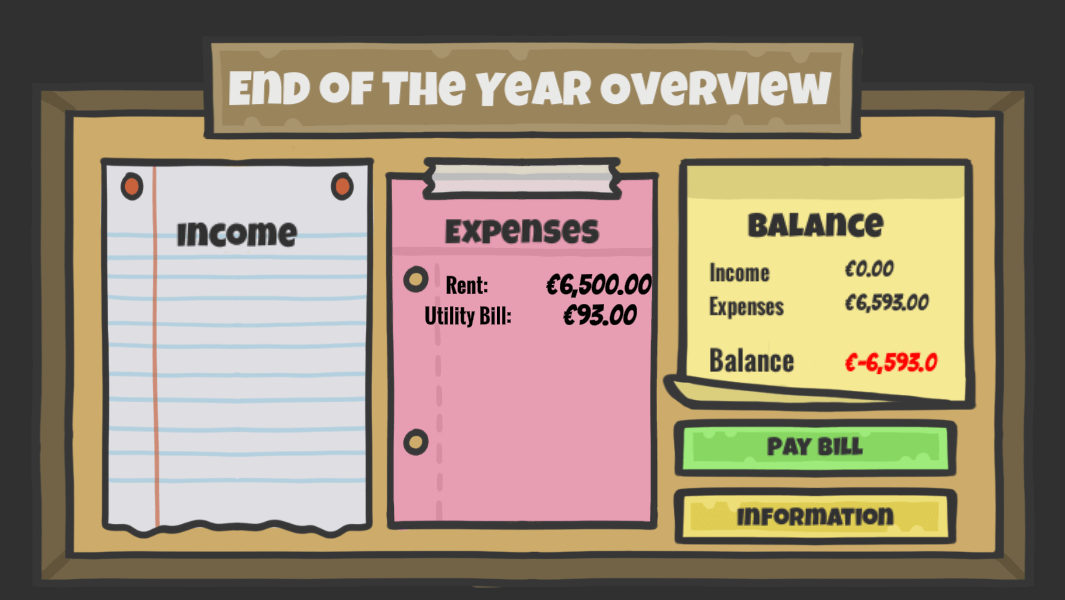

Money Monsters hi diretta primarjament lejn tfal tal-iskola primarja fejn l-għan tal-logħba huwa li jgħallmu lit-tfal ċerti kunċetti ta’ immaniġġjar ta’ flus bħall-prijoritizzazzjoni dwar il-ħtiġijiet u x-xewqat, li taqla’ l-flus, l-ibbaġitjar u l-bqija.

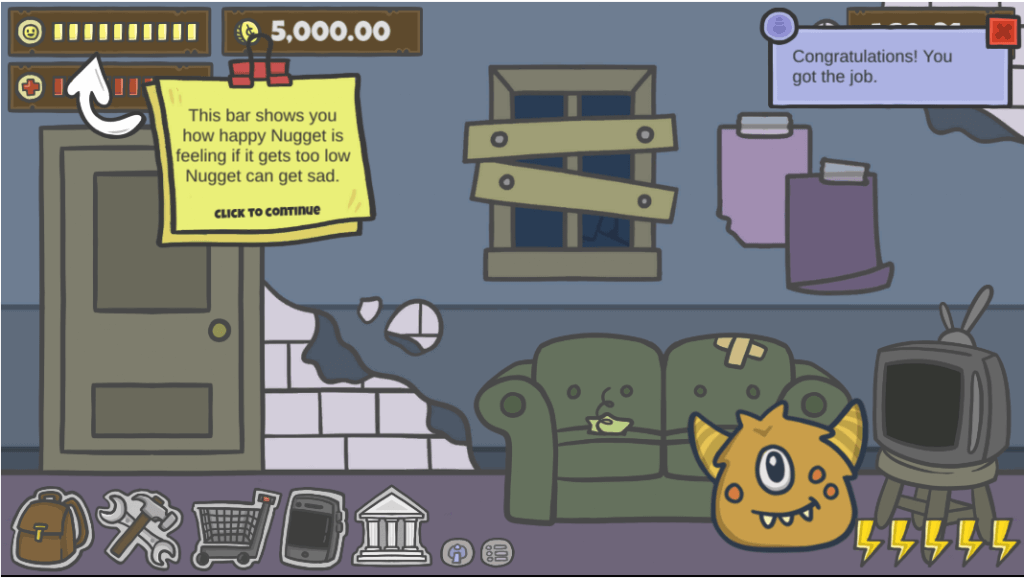

Il-logħba hi bbażata fuq monstru li jismu Nugget, li jittieħed tul vjaġġ tal-ħajja minn 18-il sena sa 65 sena sakemm jirtira. Matul dan il-vjaġġ tal-ħajja, Nugget se jkollu jagħmel għażliet ta’ flus li se jaffettwaw kif hu jipprogressa matul il-logħba. Kull azzjoni meħuda għandha impatt fuq il-ħajja ta’ Nugget li tagħti lit-tfal l-opportunità li jitgħallmu mid-deċiżjonijiet tagħhom li jirriżultaw f’riżultati differenti. Money Monsters għandha ħafna mini-games li t-tfal jistgħu jilagħbu b’mod divertenti.

F’Money Monsters tista’ tagħżel jekk tilgħabx il-logħba bil-Malti jew bl-Ingliż u wieħed jista’ jagħżel li jeħodha f’livell ogħla.

Il-livell l-aktar diffiċli jinkludi s-sistema bankarja li taffettwa kif jiġi kkalkulat il-punteġġ finali ta’ dak li jkun. Fil-logħba hemm ukoll manwal tal-logħba biex jiggwida kif wieħed jilgħab il-logħba u jifhem l-kunċetti differenti.

Il-logħba ġiet żviluppata mad-Diviżjoni tal-Edukazzjoni, id-Direttorat għall-Assistenza fit-Tagħlim u l-Programmi. Is-Sinjura Joanne Zammit, l-Uffiċjal Edukattiv tal-Istudji Kummerċjali, issorveljat id-disinn tal-logħba minn perspettiva edukattiva u appoġġat il-proġett pilota fl-iskejjel primarji fi ħdan il-Kulleġġ San Nikola.

ĠEMMA tirringrazzja lil Dr Charlie Abela u lil Dr Joel Azzopardi fid-Dipartiment tal-Intelliġenza Artifiċjali li mexxew lit-tim li fassal il-logħba dwar il-proċess tal-estrazzjoni tad-dejta u l-iżvilupp tal-gamifikazzjoni. ĠEMMA tirringrazzja lit-tim ta’ Money Monsters li ħoloq l-ewwel logħba edukattiva serja dwar il-kapaċità finanzjarja stabbilita fi ħdan il-kunċett Malti.